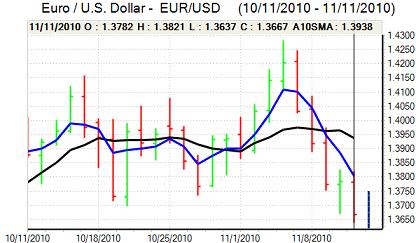

EUR/USD

The Euro was again unable to sustain rallies during Thursday and retreated to six-week lows near 1.36 against the dollar. Trading conditions were inevitably subdued during the North American session with a US market holiday.

Tensions within Euro-zone bond markets remained a serious market feature as confidence in Ireland continued to deteriorate. There was a further widening in yield spreads to record highs as Irish benchmark yields rose to 9.2% and there was also increased speculation that Ireland would need some form of multilateral rescue from the IMF within the next few months.

There was a significant contagion effect with reduced confidence in countries such as Portugal and Spain while there were also fears over long-term sovereign ratings implications. The latest GDP growth data will be watched closely on Friday and any evidence that growth was faltering would have a further negative Euro impact

The US dollar continued to derive some support from a rise in yields, but sentiment was still very cautious. The G20 meetings will continue to be watched closely with US Treasury Secretary Geithner on Thursday denying again that the US would seek to gain competitive advantage through a weak dollar. Serious tensions would have a mixed impact on the dollar as a potential loss of confidence in the US currency would tend to be offset by heightened risk aversion.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to find support near 82 against the yen during Thursday and maintained a slightly firmer tone with an advance to the 82.60 area in early Asia on Friday. There was further evidence that short dollar positions were being covered and the US currency also gained further support from higher US Treasury yields.

Trends in risk appetite will be watched closely as any escalation of G20 tensions over currency levels would tend to undermine global confidence and provide some degree of yen protection. An increase in sovereign risk fears would also tend to trigger defensive yen demand and curb capital outflows. In contrast, agreement over the need to avoid disorderly exchange rate movements would tend to weaken yen demand to some extent.

Sterling

Sterling found support below 1.61 against the dollar during the past 24 hours while there was selling pressure near 1.62 as the main Sterling focus was on the Euro cross. The UK currency strengthened to 7-week highs beyond 0.85 as Euro sentiment continued to deteriorate.

Sterling will continue to gain some support from Euro-zone debt fears with the UK seen as a more attractive option in current market conditions, especially if European sovereign credit ratings come under renewed pressure.

There will, however, be some concerns over the UK exposure to Irish banking-sector losses and any UK involvement in support measures for Ireland could also have a negative impact

Domestically, there was a small decline in Nationwide consumer confidence and there will be scope for a deterioration in confidence surrounding the economy which will also tend to limit the scope for Sterling buying. Volatility will be an important feature as sentiment towards all major currencies is liable to swing sharply.

Swiss franc

The Euro was resilient against the franc for much of Thursday, but was then subjected to renewed selling pressure with a test of support below 1.33. The dollar was able to secure a significant advance against the franc with highs near 0.98.

International policy developments will tend to dominate in the near term and there will be further defensive franc demand on fears over Euro-zone stability. If stresses intensify, there will be speculation that the franc could appreciate to beyond 1.30 and test record highs.

There will also be unease over the Swiss economy which will tend to curb franc buying and there will be some speculation that the National Bank will look to stabilise markets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

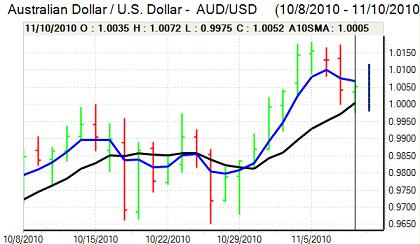

Australian dollar

The Australian dollar was unable to extend gains beyond 1.0050 against the US currency on Friday and was then subjected to renewed selling pressure during the US session as the Euro was subjected to renewed selling pressure. There was no recovery in early Asia on Friday with the currency testing support in the 0.9950 area.

There will be concerns over domestic growth trends and there will also be fears that China will need to tighten monetary policy further which would tend to curb Asian growth expectations. The Australian dollar will still gain support on yield grounds and there will be buying support on dips.