Here are a few questions from a subscriber on T3Live:

Hi Scott,

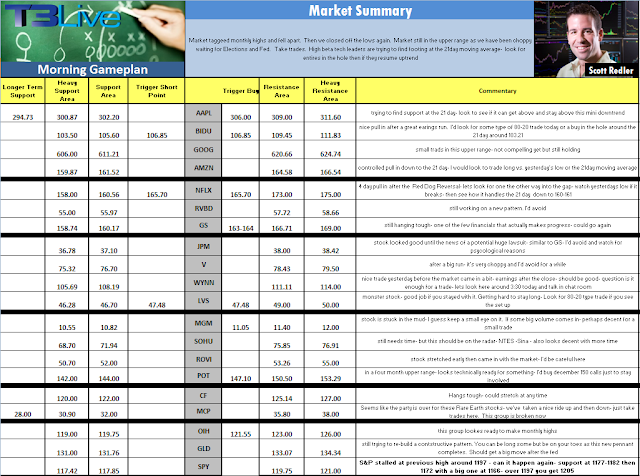

I wanted to thank you for all the support and guidance you give us each day. Between your morning calls, your recap at the end of the day and on the broadcast I really get the commitment you have to each one of us being successful and it says a lot about you and T3 Live. That being said, thanks for sending your price point sheet via email. In reading it, I have a few questions.

- I noticed on certain stocks you have both a trigger buy and trigger short at the same price – for example BIDU – you have a trigger buy and short at 106.85 – it is a little confusing – please explain?

- You have certain stocks listed with no trigger buy or short but you give us the levels of support and resistance – are these just stocks you have on your watchlist?

- I have heard you talk about A, B, C lists – are these your go to stocks and how do you categorize them A vs. B vs. C – to you break them up on your watchlist – do you delineate them based on long and short term trades – please explain?

Thanks in advance for your help. I look forward to hearing from you.

Thank you for the questions, here are my answers to each:

- Whenever I list a stock with a trigger buy and trigger short at the same price, that means I see it as a strong candidate for a Red Dog, or 80-20, Reversal trade. The Red Dog Reversal is a strategy to find a calculated top or bottom in a stock that is very overbought or oversold. For example, if a stock has seen several down days in a row and is highly oversold, the better risk-reward trade is usually a counter-trend scenario. In this case, I will look for a stock to open above the previous day’s low, trade down through it and then reverse back to the upside. While the previous day’s low (the price listed on the price point sheet) can be used for a quick cash flow short, it then becomes a trigger buy for a larger, more calculated trade. I will then buy the stock on a break back above the previous day’s low using the new low as my out in case it goes against me. The scenario presents very limited risk and potentially high reward.

- For example this morning, I listed Las Vegas Sand Corp. (NYSE:LVS), Baidu.com, Inc. (Nasdaq:BIDU) and Netflix, Inc. (Nasdaq:NFLX) as Red Dog Reversal candidates, but the market did not get early selling pressure after the gap up and these stocks did not trade through the previous day’s low.

Yes, that is a good way to understand it, and perhaps my answer to your third question will clarify this. I always watch a basket of stocks, but don’t necessarily prioritize them the same way each morning. The ones that do not have trigger long or short points are ones that I am watching, but will not be aggressive with.

As you can see on my price point sheet, there are always 22-25 stocks listed. You cannot expect to watch all of those stocks off the open, so you have to do your homework to prioritize them based on your strategy. Some stocks have better set-ups than others, and I rank them A-C. A: has clear, decisive pattern with good consolidation and an actionable area that also provides a defined risk-reward parameter. These are the ones I watch off the open and am ready to put into play. B: a pattern is starting to set-up, but it needs more time to build a base or digest a move before I feel confident in attacking the trade. If all goes to plan, with more time these will become A set-ups. C: these are trades that are choppy or laggards, which I don’t like to trade. Sometimes there will be a decent pattern with a laggard and I will denote it as a C type of play, which means I may give it a try but I will do so in small size with very tight stops.

|

| Notice this morning there were three Red Dog Reversal candidates BIDU, NFLX and LVS, but they never traded through the previous day’s low. |