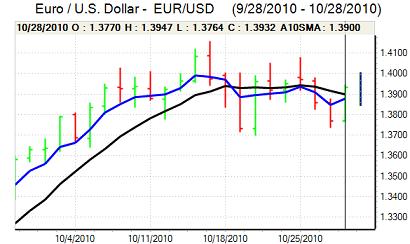

EUR/USD

The Euro found support close to 1.38 against the dollar on Thursday and steadily during the US session as the US currency was subjected to renewed selling pressure.

Uncertainty surrounding Federal Reserve’s policy actions remained an extremely important focus and there was fresh speculation that the FOMC could adopt a more aggressive stance on bond buying with a multi-month programme above US$500bn. This reversal of speculation lowered US Treasury yields and also cut demand for the dollar, but uncertainty will remain a very important feature ahead of next Wednesday’s meeting.

The US economic data was better than expected with a decline in jobless claims to 434,000 in the latest week from a revised 455,000 previously which should provide some degree of relief as the data over the past few weeks as a whole has shown a clear improvement.

Events within the Euro-zone were of secondary importance, but could have important medium-term implications. The latest ECB survey recorded a tightening in lending standards during the fourth quarter as banks maintained an extremely cautious stance. The lack of credit availability will make it more difficult for the ECB to withdraw extraordinary liquidity and will also maintain market fears over the health of the banking system. There will also be fresh concerns over the structural vulnerabilities.

The Euro pushed to a peak around 1.3950 before weakening back to the 1.39 area with an increase in risk aversion contributing to the corrective tone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a fresh challenge on resistance levels close to 82 against the yen during Thursday and dipped sharply in US trading with further selling pressure in Asia on Friday.

The decline in US yields had a negative dollar impact, but there was also evidence of increased defensive yen demand which underpinned the currency.

There were increased concerns over the regional growth outlook following weaker than expected Korean industrial data and the Japanese data was also significantly weaker than expected with a 1.9% decline for October, the fourth consecutive decline.

There was increased yen demand on the crosses with the dollar weakening to re-rest support levels near 80.50. There will be additional pressure on the Bank of Japan to intervene as the dollar approaches record lows.

Sterling

Sterling found support below 1.58 against the dollar on Thursday and advanced firmly in US trading with a peak above 1.5950. Although the US currency was generally vulnerable, Sterling held its ground against a firm Euro with gains to near 0.8710.

The UK economic data offered some support with the latest CBI retail sales survey still robust at 36 for October while there was a slight improvement in consumer confidence for the month which continued to dampen expectations of further Bank of England monetary easing.

With major doubts over the US and Euro-zone outlooks, Sterling could continue to gain some support as an alternative reserve currency, especially if ratings agencies maintain a favourable outlook. This positive sentiment could still reverse very quickly if forthcoming data and survey evidence is weaker than expected and a key feature is liable to be rising volatility.

Swiss franc

The franc maintained a slightly defensive tone on the crosses and weakened to lows beyond 1.3720 against the Euro before a partial reversal. The dollar found support close to 0.98 before a recovery to the 0.9850 area on Friday.

National Bank Chairman Hildebrand stated that monetary policy was appropriate despite risks that very low interest rates will fuel asset-price bubbles, especially in the housing sector. There will be some pressure on the central bank to adopt a more restrictive policy during 2011 which will help underpin the franc.

Given doubts over the global economy and Euro-zone vulnerabilities, capital flows out of the franc in search of higher yields should be limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

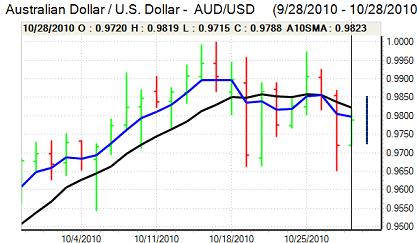

Australian dollar

The Australian dollar gained renewed support from a weaker US currency trend on Thursday and advanced to a high just above the 0.98 level.

There was no major support on domestic grounds with subdued private-sector credit growth and further speculation that the Reserve Bank would not increase interest rates next week, although there was still a high degree of uncertainty over policy intentions.

There was a deterioration in risk appetite following the international industrial releases and the Australian currency retreated back to the 0.9750 area in Asia on Friday.