It is one of the first days where earnings have not been able to pop up the market at least to start the day. A number of disappointments from world markets and the American market’s earnings have left things looking down to start the day. Currently, we are holding one open position in Skechers Inc. (SKX) at 23.80. The company has no movement in pre-market, but Coach (COH), a company in the footwear/textile industry, reported outstanding earnings that took it 6% higher. Hopefully this will play into SKX’s favor.

Yesterday, we closed out three positions to start the week in the green. We got out of Atlas Air Worldwide (AAWW) before earnings after a 3% gain. We exited Trina Solar for an almost 4% gain, and we were able to slip out of GFI Group (GFIG) for a 2% gain.

This morning we have two new plays of the day…

Buy Pick of the Day: Entegris Inc. (ENTG)

Buy Pick of the Day: Entegris Inc. (ENTG)

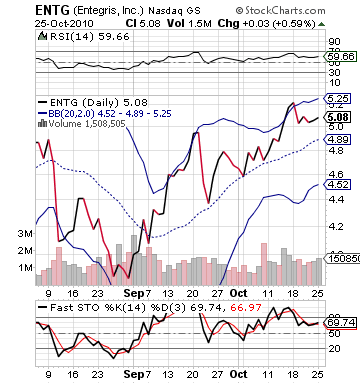

Analysis: We are taking a look at Entegris for our Buy Pick after some very solid earnings from the company and a push well over $5. The company reported earnings and revenue that beat estimates. Revenue came in at $178M versus the expectations of $172M. The company earned 0.19 per share, which was better than the 0.18 EPS. The company, further, had very strong Q4 outlook, which beat the street as well with EPS of 0.17 – 0.19 versus expectations at 0.16. The outlook over anything else is helping push the stock up 6% in pre-market trading.

While I typically never want us to get involved with big gap ups, unless we are short selling, Entegris is different. The reason is that the stock has moved well into a safe $5 zone where investors, mutual funds, and institutions are more likely to buy it up in the same way Krispy Kreme (KKD) has been bought up with heavier volume/demand. ENTG should start today and move up throughout the day as the same thing happens to it.

The company, further, showed some very positive signs in pre-market already when it dipped to 5.30 area near 8:50 AM. Immediately, the stock jumped back to 5.40. Futures are down, which makes this pick a it more risky; however, it will most likely only cause a slight dip to start before the stock rallies.

Technically, while the stock is about to break out of its upper bollinger band, there is reason to believe…