Profile

Paychex Inc. (PAYX) is involved in the outsourcing of payrolls. The company focuses on outsourcing payroll for small to  medium-sized businesses that have around fifth to 100 employees. The company was founded in 1971 in Rochester, New York, and it was grown in 1979 by consolidating 17 payroll processors. The company services over 550,000 clients. The company is the second largest payroll outsourcing firm behind Automatic Data Processing Inc. (ADP).

medium-sized businesses that have around fifth to 100 employees. The company was founded in 1971 in Rochester, New York, and it was grown in 1979 by consolidating 17 payroll processors. The company services over 550,000 clients. The company is the second largest payroll outsourcing firm behind Automatic Data Processing Inc. (ADP).

Thesis

Paychex Inc. (PAYX) is an attractive longterm position for several reasons. The company is a leader in a fairly uncompetitive industry with a wide economic moat that is created by the company’s significant competitive advantage and top notch brand image. The company has a low cost of doing business. Further, Paychex has one of the swellest dividends one could hope for that gives a yield above 4% and has little risk of being threatened.

Paychex’s economic moat begins with heavy costs of entering the business but low costs of operation. The cost of switching payroll processors and high scalability gives the firm a significant advantage of any firm entering the industry. Additionally, Paychex has the respect of forty years of doing business that have allowed it to grow and keep customers. Small businesses also are less likely to take on new businesses since margins are less significant and heavy costs are avoided.

Paychex benefits its investors most significantly through its ability to have a very low cost of business. The company’s free cash flow is significant each year. They have had FCF over $500 million for the past four year. The latest FY, which ended in May 2010, saw the company earning $550 million in FCF and obtaining a FCF margin of 27%. A rate of 10-12% is considered healthy. That heavy dose of FCF is pumped back into business developments and investors through the dividend. The company, currently, operates a dividend of $1.24 per share for a yield of 4.5%. With such a significant FCF margin, the dividend seems very safe, and it allows investors to sop up some significant dividend payments while waiting for the company to grow.

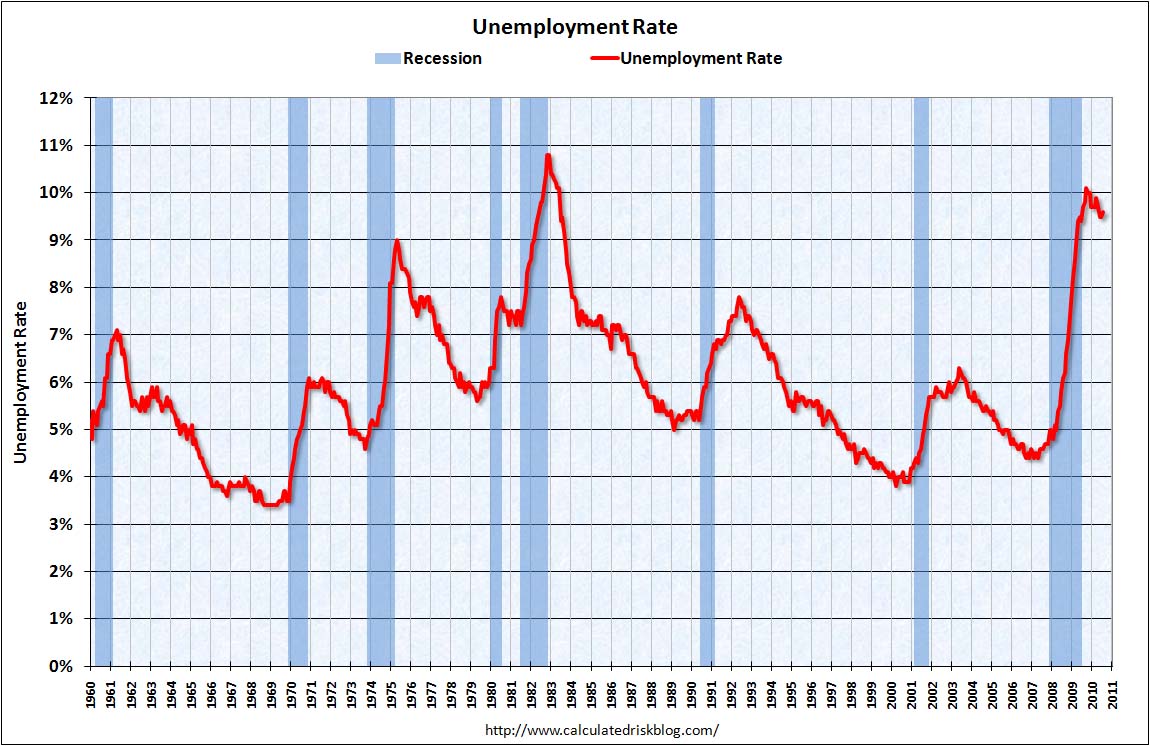

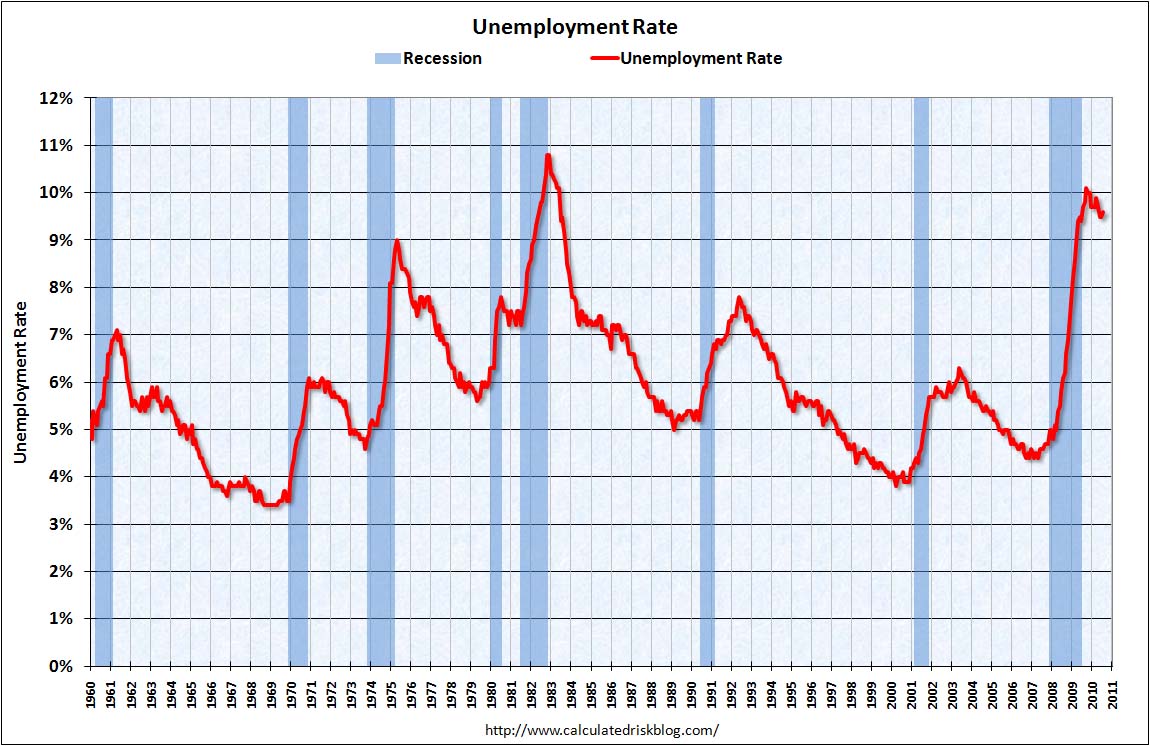

The question with Paychex is can it grow. The company has seen no growth since 2008. The company continues to lose business. In its latest quarter, the company saw another 12% of business drop out the bottom on its paycheck business. The company has battled some of its loss here with gains in its human resources…