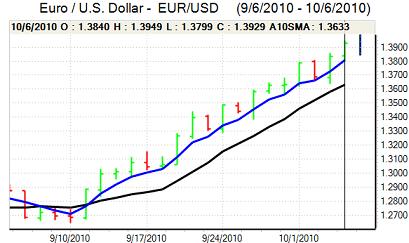

EUR/USD

The Euro maintained a firm tone in early Europe on Wednesday, but failed to make a decisive break above 1.3850 and then dipped weaker. The Euro was unsettled by renewed fears over the Euro-zone economy as ratings agency Fitch issued a further downgrade of the Irish credit rating. There will certainly be persistent fears surrounding the financial sector and peripheral economies.

In this environment, the ECB will need to maintain an aggressive stance on monetary policy and will find it very difficult to withdraw extraordinary liquidity measures. The ECB is likely to maintain a more confident stance towards growth at Thursday’s council meeting which could provide some Euro support. Markets will also monitor closely any comments on global currency levels.

The US ADP employment data was significantly weaker than expected with a decline of 39,000 for September following a revised 10,000 increase for August. The data reinforced fears that the US economy will be able to secure only weak growth and also undermined confidence in the key Friday payroll release.

The weak data also reinforced expectations that the Federal Reserve would sanction a further quantitative easing at the November FOMC meeting. In this environment, the dollar remained under heavy selling pressure and weakened to fresh eight-month lows beyond 1.3920 against the Euro. The Euro also gained support on technical grounds as it broke through important resistance levels against the US currency with a break above the 20-day moving average.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Trading conditions were generally subdued during Asian trading on Wednesday with markets waiting for fresh action by the global central banks. There was a further reluctance to sell the dollar given that it was very close to levels which originally triggered intervention. The improvement in risk appetite also curbed yen demand on the crosses. The dollar, however, was unable to secure any buying support given the weak yield support and it remained trapped just above the 83 level.

The weak US economic data put the dollar under fresh selling pressure in US trading on Wednesday and dipped to lows near 82.80 against the yen. There was no evidence of Bank of Japan intervention and the dollar only managed to secure a very small corrective recovery later in the US session.

Markets will need to watch international comments on currencies closely over the next 48 hours with the IMF meetings due to be held from Friday-Sunday. Any agreement on a push for stronger Asian currencies could support the yen.

Sterling

Sterling hit resistance above 1.59 against the dollar in early Europe on Wednesday and retreated to lows near 1.5830 ahead of the US open as European currencies generally retreated.

There were no major data releases during the day with no further evidence for the Bank of England to assess ahead of the Thursday interest rate decision. There will be some further speculation that the MPC will decide on a further quantitative easing at the meeting.

There is certainly likely to be a split decision at the meeting which could lead to a surprise outcome, although it is more likely that the bank will decide to hold policy steady at this time. Sterling will come under heavy initial selling pressure if there is a boost to quantitative easing.

Selling pressure could ease quickly given expectations that central banks elsewhere will provide support to their economies. Dollar weakness dominated again in US trading on Wednesday with Sterling hitting further resistance above the 1.59 level while it weakened to a five-month low near 0.8770 against the Euro.

Swiss franc

The Euro hit resistance above 1.34 against the franc on Wednesday and retreated to lows near 1.3320 before finding fresh support. The dollar also remained under pressure and dipped to fresh 30-month lows near 0.96 against the Swiss currency.

The franc gained defensive support from Fitch’s downgrade of Ireland’s credit rating and there will be further concerns over the Euro-zone financial-sector outlook which will also maintain some underlying demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

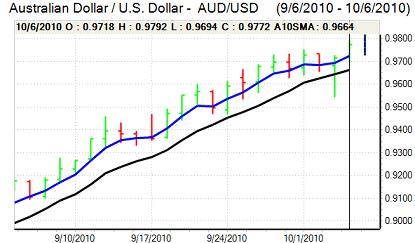

Australian dollar

Following the strong recovery in US trading on Tuesday, the Australian dollar was able to maintain a firm tone during Wednesday and hit a fresh 2-year peak close to 0.98 against the US currency.

There were no major domestic influences during the day with the themes of dollar weakness and potential quantitative easing by global central banks the dominant influences. US currency weakness provided important support for the Australian currency while expectations of bank actions to ease monetary policy also maintained a flow of funds into commodities which helped support the Australian dollar.