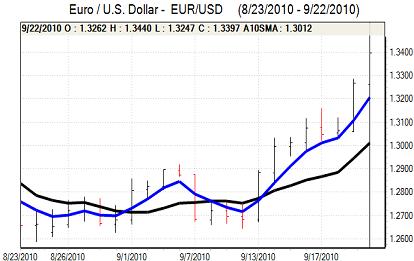

EUR/USD

The Euro found support below 1.33 against the dollar in Europe on Wednesday and advanced strongly during the session.

As far as the Euro-zone is concerned, there was further solid demand at the latest Portuguese bond auction, maintaining the positive tone seen over the past few days and this continued to provide Euro backing. In this environment, the Euro was able to withstand any negative impact from weaker than expected industrial orders data.

There were no major US data releases during the session while there was a reported 0.5% decline in house prices for July following a revised 1.2% decline the previous month. The data will reinforce expectations that the housing sector will remain weak and will also maintain expectations that the Fed will need to consider further quantitative easing over the next few months.

The lack of yield support ensured that the dollar will remain dependent on a deterioration in risk appetite and defensive support for any strong gains. There have certainly been doubts over the global economy, but there has been no deterioration in credit conditions and this has limited dollar support.

The Euro pushed to 5-month highs above 1.3430 and was able to consolidate above 1.3380 later in the US session as underlying dollar demand remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

General US dollar vulnerability remained a negative factor in Asia on Wednesday with lows around 84.80 against the yen. Prime Minister Kan stated that the authorities were prepared to intervene again while central bank governor Shirakawa stated that the bank could provide additional support for the economy. There were reports that the central bank has asked commercial dealers to work on Thursday during a market holiday which reinforced speculation over potential intervention

Markets will, therefore, remain on high alert over further intervention which will tend to deter aggressive yen buying and there will also be some potential shift of funds into commodity currencies.

Wider dollar vulnerability pushed the US currency to lows near 84.25 against the Japanese currency in New York before a move back to the 84.50 area with markets reluctant to push the US dollar aggressively lower.

Sterling

Dollar weakness dominated in early Europe on Wednesday with a Sterling high near 1.5680 as markets continued to focus on Wednesday’s FOMC statement.

Domestically, the Bank of England minutes reported a 8-1 vote for unchanged interest rates at the September MPC meeting. As in the previous meetings, Sentence dissented from the decision and voted for a 0.25% increase in rates to 0.50%.

The minutes were generally downbeat over the economic outlook with concerns that conditions would deteriorate again over the next few months. There were also suggestions that further quantitative easing would be considered to combat any slowdown. The more dovish that expected minutes pushed Sterling sharply lower with a trough near 1.56 after an early high above 1.57.

Sterling recovered ground as the dollar remained under general pressure, but the UK currency weakened to lows beyond 0.8575 against the Euro and also dipped to a two-month low on a trade-weighted basis.

Swiss franc

The Euro pushed to a high just above 1.3250 against the franc during Wednesday, but it was unable to sustain the gains and drifted back towards 1.32. The dollar remained firmly on the defensive and dipped to 30-month lows below 0.9850 before finding some relief.

Although there was greater confidence surrounding Euro-zone bond markets, the Swiss currency was still able to resist significant selling pressure. There is an underlying lack of longer-term confidence in the dollar and Euro with fears that currency depreciation will effectively be used as a policy weapon to combat economic weakness and this will continue to trigger some defensive franc demand.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

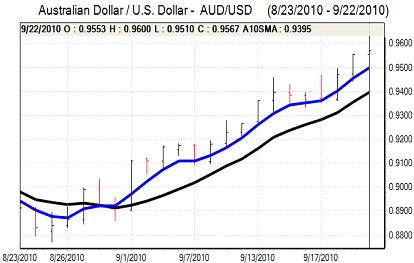

Australian dollar

The Australian dollar maintained a very firm tone in Asian trading on Wednesday and strengthened to a fresh 2-year high near 0.96 as the US currency remained firmly on the defensive.

There were no major data releases during the day and underlying confidence in the domestic economy remained firm with expectations of higher interest rates. Risk appetite was resilient, but commodity prices struggled to rebound and this will pose a threat to the Australian currency. Markets will still be looking to challenge parity during the next few weeks as the dollar consolidated above 0.9550 in New York.