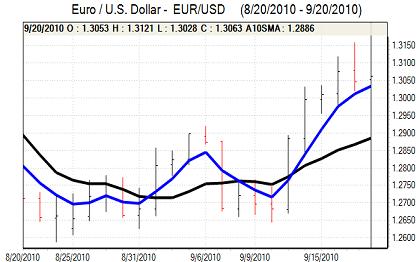

EUR/USD

The Euro found support above 1.3050 against the dollar in early Europe on Monday and again tested resistance levels above 1.31, but was unable to break higher.

There were further underlying concerns over the European debt profile during Monday and this was important in stifling Euro support. There was a further widening of Portuguese yield spreads over German bonds with the gap reaching a record level since the start of EMU. There were further concerns over the Irish budget outlook and possibility that further IMF support will be needed. There was also unease over the Greek banking sector as banking-sector stress tests were postponed.

Euro selling pressure has been contained at this stage, but any further deterioration in sentiment towards the financial sector could lead to heavy selling pressure.

There was only limited US data with the NAHB housing-sector index remaining at a depressed level of 13 for September which will maintain a lack of confidence in the sector.

The main focus was on Tuesday’s FOMC meeting and the possibility of further Fed action. If the FOMC moves to expand quantitative easing this week then the dollar will be vulnerable to further selling heavy pressure. It is more likely that the Fed will hold steady for now and this would provide some relief for the US currency, at least on a short-term view. The Euro dipped to test support levels near 1.3030 during US trading before stabilising near 1.3060.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Trading ranges were extremely narrow on Monday with Tokyo markets on holiday and there were no substantive comments from key officials. The dollar consolidated close to 85.80 against the yen in subdued conditions with no evidence of Bank of Japan intervention during the session.

There was a decline in long speculative yen positions according to the latest data, but there was still an extensive net long position and this should limit the scope for fresh yen buying, especially given fears that there will be further official action.

Market conditions remained very quiet over the remainder of Monday with the dollar finding support on dips to the 85.50 area despite nerves over the Fed.

Sterling

The Rightmove organisation reported a further decline in asking prices for houses for September, which will maintain concerns over the sector. Sterling was initially resilient with support above 1.5620 against the dollar while gains were capped around 1.5680.

The latest Bank of England lending data was weaker than expected with a further year-on-year decline in business lending while the money supply data was weak. The data will maintain concerns over a renewed credit crunch and the weak housing data gradually had a greater impact on the currency. Sterling weakened to lows below 1.5550 against the dollar and also tested 7-week lows beyond 0.84 against the Euro.

There were reports of Asian buying which cushioned the currency to some extent while Moody’s stated that the UK AAA credit rating should be able to withstand the challenges.

The latest government borrowing data will be watched closely on Tuesday and a worse than expected report would renew UK structural fears. The Bank of England minutes due on Wednesday will also be watched closely to assess the central bank’s likely intent.

Swiss franc

Franc volatility levels eased slightly on Monday, but there were still erratic moves during the day. The Euro was unable to sustain gains above 1.32 against the franc and dipped to lows near 1.3110. The dollar also remained on the defensive with lows below 1.0050.

Confidence in the gloal economy tended to fade slightly during the day which provided franc support. The currency also drew buying interest from persistent unease surrounding Euro-zone debt trends.

The trade data will be watched closely on Tuesday and competitiveness fears will ease slightly if there is a solid reading for exports.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

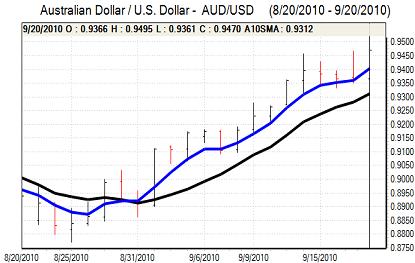

Australian dollar

The Australian dollar gained renewed support in Asian trading on Monday and re-tested highs near 0.9460 against the US dollar.

Reserve Bank Governor Stevens was generally optimistic over the economic outlook and also suggested that the next move in interest rates was likely to be for a further increase. The generally hawkish rhetoric provided support to the Australian dollar, especially with speculation that the US Federal Reserve could adopt further quantitative easing.

The currency pushed to a high just below 0.95 later in the US session as markets looked to trigger stop-loss buying before consolidation above 0.9450.