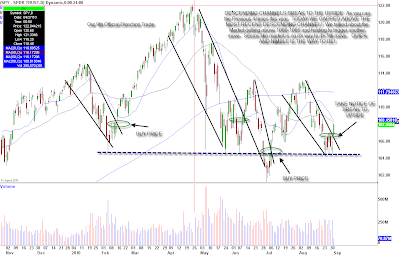

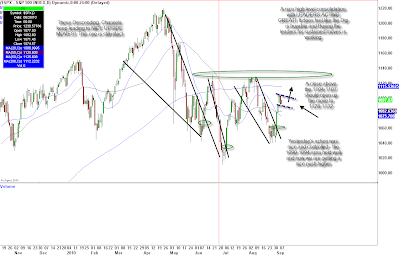

It’s very important to measure the action once a new uptrend starts. On September 1st, the gap and go above 1060-1065 ignited a new move. The next week the S&P held 1090-1092 showing commitment to the move (the leaders acted well during this consolidation). Last week the market held its 200 day moving average at 1113-1115 for almost 5 days, and today the market broke out and is hitting 1142-1144. The next level is 1160.

Everyone is very excited now, but you should only be excited if you stayed in the move, measured the action, and took cash flow trades in all these leading stocks

This is our list of go-to stocks, which are the best acting stocks in the market: AAPL, AMZN, BIDU, NFLX, VMW,CMG, FCX, CRM, WYNN, LVS, GS, BAC. I think the banks can be the ones to go tomorrow

Everyone complains, but there is not much to complain about if you’re in the trenches day in and day out.

It is important to note that sometimes they run us into fed day and then put another short term top in. We just went from 1040 to almost 1140, one hundred handles. 1144 in the short-term and then 1055-1160 should be tough spot, especially if we get there quickly.

Take a look at these four charts with commentary to show how you can measure the action the next time. Each Chart is in our blog and was documented explaining the composure every step of the way. You should only be excited if you held and traded and took some profits as the shorts got capitulated through this area.

September 1st, 8th, and 15th