![[FANREO]](http://sg.wsj.net/public/resources/images/MI-BF965_FANREO_NS_20100916200301.gif) Our zombie GSE’s have now become the Nation’s biggest home sellers.

Our zombie GSE’s have now become the Nation’s biggest home sellers.

This could not come at a worse time as winter is always a poor time to sell homes, rates seem to have bottomed and there is no new stimulus (or new jobs, or immigration, or population growth) to spur demand. Yet, Freddie Mac and Fannie Mae now own more than 191,000 homes(as of June 30th), which is double where they were last year and they are still taking back homes faster than they can sell them as we move into the peak (we hope!) of the foreclosure cycle.

Once they take homes back, Fannie and Freddie must not only cover the utility bills and property taxes, but they are also relying on thousands of real-estate agents and contractors to rehabilitate homes, mow lawns and clean pools. Fannie took a $13 billion charge during the second quarter just on carrying costs for its properties.

If demand remains weak, Fannie and Freddie could face pressure to take more aggressive steps to hold homes off the market. Fannie, for example, is testing an effort in Chicago where it will rent vacant foreclosures rather than list them for sale. Such a “lease-and-hold” approach could make sense in certain markets where “you believe the supply will take a long time to absorb, but there’s going to be an increase in employment going forward,” says Douglas Duncan, chief economist at Fannie Mae.

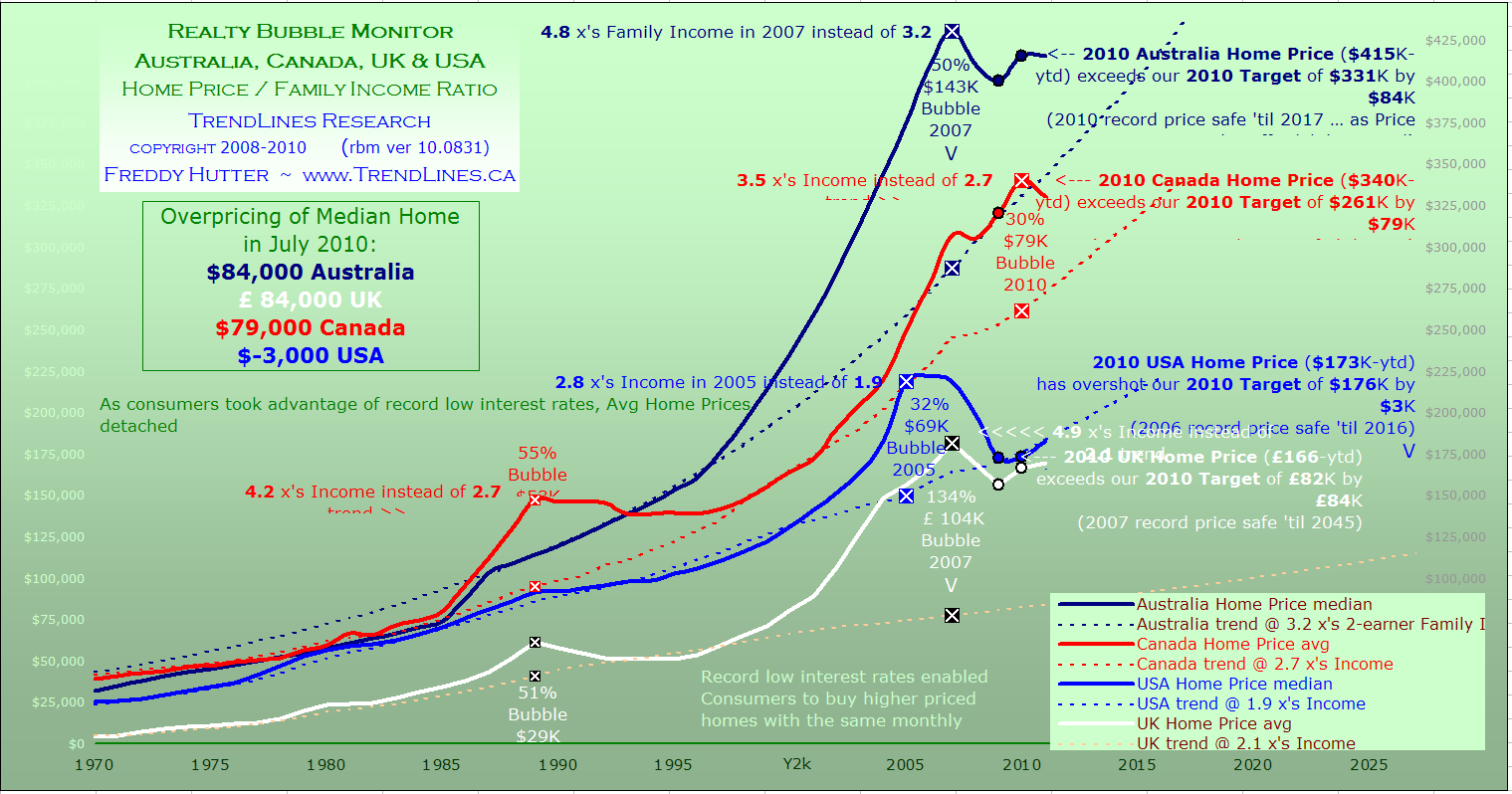

In yesterday’s post, we discussed the death of the housing market and that brought about a discussion in Member Chat about my February article where I pointed out that the math of home ownership no longer works for many Americans (I also showed 3 different ways you can shave $100,000 in payments off a $200,000 home loan so I do suggest reading it if you haven’t already). Mark McHugh of The Daily Bail has a nice update today where he does the math and contends that “a look behind the numbers shows home ownership to be a poor investment.” Barry Rhitholtz found a chart from Reality Bubble Monitor that matches with my contention yesterday (that the US has likely bottomed) but points out that our “boom” economies in Australia and Canada (and China is about the same) have bubbles that are still likely to pop:

As I said yesterday, home prices are all about affordability of mortgages and should we get into a rising rate environment, we could see additional, steep declines in housing prices. That remains our overriding concern…