By: Scott Redler

The question is, now what? Yesterday was a very controlled down move to fill Friday’s Gap after a very strong week, very constructive action for the long side. First support held at 1090-1093. Today Futures are up a bit with the Portugal bond auction easing some fears in Europe (I guess). At least now we have a new point of reference as we move forward (1091-yesterday’s low).

Leaders did act well as the market retreated yesterday, with some green across the board. In a bearish tape high beta names or high P/E names usually come in quicker and faster. Lately the leaders have acted well and held up when the S&P’s come in.

So that’s worth noting.

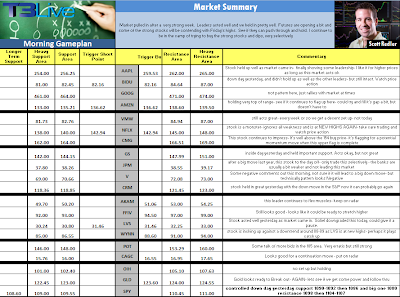

If we don’t hold yesterday’s low then next small support is 1086, with a nice area I will take a big look at around 1078-1083. I am still trying to buy this dip, and look for strong stocks to create cash flow trades. Today I am going to give another free sample of my Morning Gameplan sheet available everyday on T3Live.com so you can see the important levels as I do.