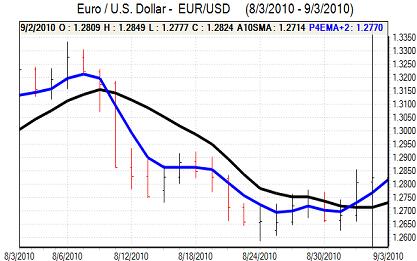

EUR/USD

The Euro tested resistance levels above 1.29 against the dollar in early Europe on Monday with some follow-through buying following the gains at the end of last week.

The Euro was unable to make further headway during the session and edged lower during the day with trading activity inevitably subdued as US markets were on holiday.

President Obama looked to regain some initiative on the economy following a spate of criticism and lacklustre data releases. He announced additional measures to help stimulate investment over the next few years. US markets did not have a chance to react, but the overall impact is likely to be limited at this stage given the negative underlying sentiment and pressures on credit within the economy.

The Euro was subjected to renewed selling pressure in early Asian trading on Tuesday. Although large funds may have taken advantage of low liquidity to push the currency lower, there were also fears over the Euro-zone banking sector with speculation that distressed bond holdings were larger than admitted under the recent stress tests. There were also renewed fears over sovereign debt ratings which dragged the currency to lows below 1.28.

Euro-zone leaders are due to meet to agree a second loan tranche for Greece on Tuesday and any dissent within the meeting would have a further negative impact on the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain any momentum against the yen in early Europe on Tuesday and it remained trapped below 84.50.

Risk conditions were generally firm during the session as Japanese equity markets advanced, but the dollar was unable to gain any significant support. There were expectations that US yields would remain at very low levels which would sap dollar support. Defensive yen support remained generally firm on doubts over the global economy.

The Bank of Japan left interest rates on hold at 0.10% following the regular council meeting. There were no further policy announcements which was unsurprising given that an emergency meeting had been held last week.

Sterling

The UK currency was blocked below 1.55 against the dollar in early Europe on Monday and then retreated sharply against all major currencies with a decline to below 1.5350 against the dollar.

There were reports of substantial Sterling selling by a major UK clearing bank, possibly related to a government European Union payment and this helped push the currency lower in thin trading conditions. Sterling weakened to a six-week low beyond 0.8380 against the Euro, but did find some relief against the Euro in Asia on Tuesday.

There were no major data releases during the session, although there was some reaction to a decline in August car sales and an industry survey which suggested that sales would remain weaker in the near term. Overall confidence in the economy has deteriorated following a series of weak survey readings and underlying confidence is liable to remain weaker in the near term.

There will also be further doubts whether the Bank of England will be in a position to increase interest rates which will tend to sap currency support.

Swiss franc

The Euro was unable to secure a further recovery against the franc on Monday and was subjected to renewed and heavy selling pressure in Asia on Tuesday with a slide below the 1.30 level. General franc strength prevented the dollar from making any headway and the US currency weakened to test support levels below 1.01.

Although international risk appetite held relatively firm, equity markets were unable to make further headway and the Swiss franc secured renewed defensive support from fresh concerns over the European banking sector.

Euro-zone discussions surrounding Greece will be watched closely on Tuesday and the Swiss franc will gain renewed safe-haven support if a deal is rejected.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

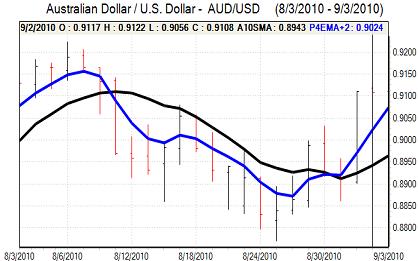

Australian dollar

The Australian dollar retained a firm tone in Europe on Monday, probing resistance levels above 0.9180 against the US dollar. The currency was unable to make further progress and dipped lower during Asian trading on Tuesday, although it maintained a resilient tone.

The domestic data remained generally disappointing with the construction PMI index trapped well below the 50 level for August, maintaining the run of disappointing survey evidence.

The continuing political deadlock was also having some negative impact, although it was expected that key independents would make a announcement on their intentions later on Tuesday.