Long Term Investment: Basic Sanitation Company of Sao Paulo (SBS)

Profile: Companhia de Saneamento Basico do Estado de Sao Paulo (Basic Sanitation Company of Sao Paulo – SBS) is the state of Sao Paulo’s environmental sanitation service company in Brazil’s financial capital. The company operates water,  sewage,a nd industrial waste treatment facilities. Founded in 1954, the company has grown with the Sao Paulo state of Brazil. The company operates in 366 municipalities, treats sewage for 26 million people, and also handles rainwater drainage and management.

sewage,a nd industrial waste treatment facilities. Founded in 1954, the company has grown with the Sao Paulo state of Brazil. The company operates in 366 municipalities, treats sewage for 26 million people, and also handles rainwater drainage and management.

Thesis

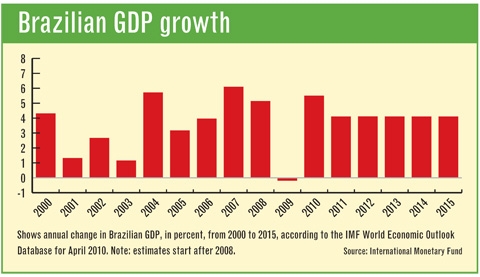

Sewage and water sanitation is not sexy. SBS is no Vale, no Google, no Trina Solar. It does not operate a very interesting business, but it has one of the largest economic moats that can exist. It has no competitors, and it will continue to grow as Brazil grows. The company continues to operate with significant free cash flow, high growth, and continues to grow out of the 2008 hit that it saw to its growth. Sanitation services companies grow as the community they are serving grow, and if there is one thing Brazil is doing, it is growing. SBS since 2005 has grown through FY 2009, from $4.9 billion in sales to $8.6 billion…growth of over 75%.

The company does not appear to be slowing down, with estimated revenue to grow 5% this year. Operating income has grown at a minumum of 30% each year, and the company returned an EPS over 4 last year, which is growing to grow to over 5. This company is your standard growth stock, but can it keep growing to increase share price. Two main catalysts to the Brazilian economy really have me excited: The World Cup and The Olympics. While the Olympics is in Rio, The World Cup will have games in Sao Paulo. This is a huge boost to sanitation facilities. According to Ernst & Young, the World Cup could have an $80 capital injection into Brazil. $12.7 billion will come from the state itself to improve infrastructure. A lot of this money is expected to go to utilities, such as water sanitation. Direct investments into SBS.

will have games in Sao Paulo. This is a huge boost to sanitation facilities. According to Ernst & Young, the World Cup could have an $80 capital injection into Brazil. $12.7 billion will come from the state itself to improve infrastructure. A lot of this money is expected to go to utilities, such as water sanitation. Direct investments into SBS.

Additionally, the Sao Paulo company is growing outside of Sao Paulo and doing projects throughout Brazil and the rest of Latin America. The company only sells at one times revenue with a P/E at 5.76. The company is heavily undervalued, and it could take off at any moment.

Forbes writer, Ken Fisher, comments, “You’re getting…