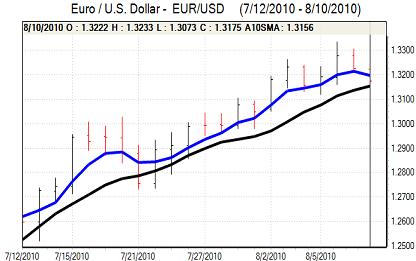

EUR/USD

The Euro retreated further to 1.3150 in Asian trading on Tuesday as the global risk environment was less favourable and there was a covering of short dollar positions.

There was inevitably caution surrounding the FOMC interest rate decision and the Euro continued to drift weaker during the European session with a trough close to 1.3080 ahead of the New York open.

As expected, the Federal Reserve left interest on hold in the 0.00-0.25% range. The FOMC statement was more cautious over the economic outlook with comments that the pace of recovery is likely to be more modest in the near term than had been expected while inflation was likely to be subdued for some time.

The Fed stated that principal payments received from mortgage-backed securities would be re-invested in longer-term US Treasuries. This was effectively a modest expansion of the quantitative easing programme as the Fed moved to prevent any reduction of liquidity.

The combination of downbeat assessment and the policy move put the dollar under pressure with the Euro moving back to the 1.32 area. There are also likely to be increased doubts over the international economy given a lack of global leadership and this may provide some degree of dollar protection.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan held interest rates at 0.1% following the latest policy meeting with a unanimous vote in favour and the bank also decided not to introduce any further measures to boost liquidity. The bank will wait for further evidence on the impact of yen strength before taking any further action.

The latest Chinese trade surplus data was strong, but there were increased doubts over the global economy, especially with unease over China’s property sector and risk conditions were less favourable which curbed selling pressure on the yen. The dollar was unable to break above the 86 area while the yen gained ground on the crosses.

After holding relatively steady for much of the day, the dollar was subjected to renewed selling pressure following the US Federal Reserve announcement with lows close to 85.20.

With the dollar again threatening a break below the 85 area, markets will remain on high alert for further verbal intervention by the Finance Ministry.

Sterling

The latest housing data was weaker than expected with the RICS survey recording a figure of -8 from the +8 the previous month which was the first monthly decline for 12 months. Unease over the housing sector helped trigger sharp Sterling losses in Asian trading on Tuesday.

The trade account data was better than expected with a decline in the goods-account deficit to GBP7.4bn from a revised GBP8.0bn the previous month. There was a monthly recovery in exports which will tend to provide some degree of relief over trends.

Sterling still weakened to lows around 1.5720 against the dollar before securing a recovery back to the 1.58 area as the Euro came under pressure against the UK currency. Renewed dollar weakness following the US Federal Reserve statement allowed a Sterling recovery to 1.59 before fresh selling pressure emerged.

The Wednesday Bank of England inflation report will be watched very closely on Wednesday and will certainly be very important for Sterling sentiment. The bank is liable to be cautious over the growth outlook while also expressing unease over the inflation outlook which would be unlikely to provide strong Sterling support.

Swiss franc

The dollar advanced strongly in the European session on Tuesday with a peak just above 1.0610 against the franc. A generally firmer tone for the US currency was compounded by franc weakness on the crosses as the Euro pushed above the 1.39 level.

Both trends reversed in the New York session, especially after the Fed rate decision and the dollar retreated back to below 1.05

There was a slight deterioration in consumer confidence according to the latest SECO survey which may increase speculation that the economic cycle is peaking, although the impact is likely to be limited. Doubts over the global economy will continue to provide significant dollar protection.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

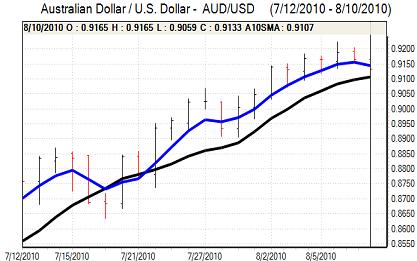

Australian dollar

There was a further Australian dollar decline to lows near 0.91 against the US dollar in local trading on Tuesday with a firmer US dollar and a more cautious attitude towards risk. The domestic NAB business confidence survey weakened for the fifth successive month, maintaining a run of disappointing Australian data and this is likely to unsettle confidence in the Australian dollar to some extent.

Global trends remained dominant over the remainder of the day and the currency rebounded to a high around 0.9160 following the dovish Fed statement, although it failed to hold its best levels.