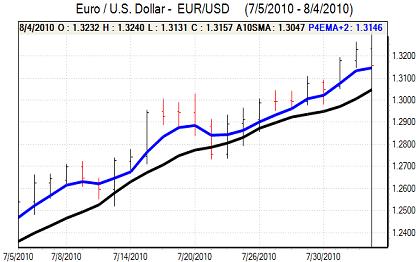

EUR/USD

The Euro tackled resistance levels above 1.32 in European trading on Wednesday, but was unable to extend the gains. The Euro-zone data did not have a major impact with the services-sector PMI data marginally weaker than expected, but there was still optimism over near-term prospects. The ECB will look to sustain the more optimistic tone at the policy meeting on Thursday and this should provide some degree of Euro support.

The US ADP employment report was slightly stronger than expected with estimated private-sector employment gains of 42,000 for July following a revised 19,000 increase the previous month. The ISM non-manufacturing data was also firmer than expected with a figure of 54.3 for July from 53.8 the previous month.

The data did not dispel doubts over the US economic strength and unease over the risk of a renewed downturn over the next few months. Fears surrounding the economy did, however, ease slightly and there was reduced speculation that the Federal Reserve would act to loosen monetary policy further at next week’s FOMC meeting.

The stabilisation in yield expectations and profit taking on long Euro positions helped push the Euro to lows near 1.3140 against the dollar, but there was evidence of buying support at lower levels. There will be caution ahead of the US payroll data with the dollar not well placed to secure strong gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The pattern of yen gains continued on Wednesday with the dollar weakening towards 15-year lows below the 85.50 level against the yen as international risk appetite was also more fragile.

There were increased fears over the impact of yen strength as the Nikkei index fell sharply. Markets remained on high alert over comments from the Finance Ministry and possible intervention by the Bank of Japan. Finance Minister Noda repeated that he was watching the currency markets closely, but there was no sign of intervention and there did not appear to be dollar buying by semi-official funds.

The dollar remained firmly on the defensive as European markets opened, but then found significant relief following the US economic data as yield expectations stabilised. Yen yields remained extremely low and there was technical support at lower levels with the dollar able to rally to the 86.25 area

Sterling

The Halifax house-price index recorded a 0.6% increase in prices for July which may soothe immediate doubts over the housing sector and this helped Sterling maintain a firm tone in early Europe on Wednesday with further technical resistance above the 1.5950 area.

In contrast, the services-sector PMI data was weaker than expected with a decline to 53.1 for July from 54.4 the previous month. This was a 13-month low for the index and increased unease over a potential slowdown in the economy. There will be renewed speculation that fiscal tightening will undermine consumer demand and also deter any significant interest rate increase by the Bank of England which would tend to sap Sterling support.

There was also evidence of profit taking after recent gains and Sterling dipped to lows near 1.5850. There was solid buying support on dips and the UK currency tested resistance levels stronger than 0.8280 against the Euro.

Swiss franc

The Euro found support close to 1.3720 against the franc on Wednesday and then strengthened sharply during the European session with a peak just above the 1.3850 level. With the dollar also reclaiming some lost ground against the Euro, the US currency advanced to a high close to 1.0550 against the Swiss currency.

A slight improvement in sentiment towards the US economy and global demand conditions curbed Swiss franc demand to some extent while technical considerations were also important as the dollar found support below the 1.04 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

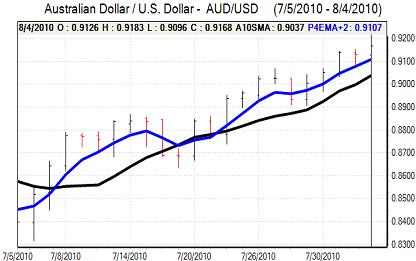

Australian dollar

Overall risk appetite was slightly weaker in Asian trading on Tuesday and a further deterioration in the PMI services-sector index is likely to increase doubts over the Australian economy which will tend to curb currency support. Unease over the global economy is likely to be offset by expectations of further US monetary easing and this should limit Australian dollar selling pressure.

In this context, a recovery in commodity prices helped the Australian dollar to a high around 0.9180 against the US currency with the Australian dollar broadly resilient later in the US session.