We have done our best to lay out our working thesis. Even so… it usually makes sense to at least contemplate a few worst case scenarios just in case.

The argument is, in a sense, that cyclical is cyclical. In a positive cyclical trend one would expect to see commodity prices rising, strength in the commodity currencies, Asian markets strength, economically sensitive equities outperforming, and interest rates tracking upwards. When one or more of these markets begins to head to the down side it may not prove to be a fatal blow to the trend but at the very least the message should be considered and examined.

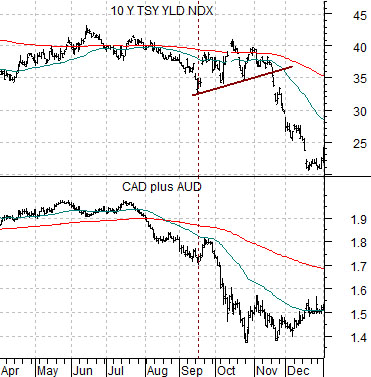

Below is a chart of 10-year Treasury yields and the sum or combination of the Canadian dollar futures and Australian dollar futures (CAD plus AUD) from April of 2008 through December of 2008.

Following the peak in commodity prices at the end of June in 2008 and a few months before Bear Stearns and Lehman circled down the drain the commodity currencies (CAD plus AUD) began to decline. Through September, October, and into November 10-year Treasury yields held near the highs as the message of slowing economic growth cast off by the forex markets failed to push money into the long end of the Treasury market. The point, however, is that the forex markets ‘said’ that there was a problem even though the bond market seemed to disagree. In due course yields collapsed.

Further below we show the CAD plus AUD once again along with 10-year Treasury yields from the current time period. Notice that we have reversed the charts so that this time yields are at the bottom.

Through the second quarter of this year 10-year Treasury yields declined in a manner similar to the commodity currencies in 2008. At the same time the commodity currencies have pushed higher in a manner reminiscent of 2008’s Treasury yields.

We argued recently that if the forex market is ‘right’ once again then yields should resolve higher later this year. Fair enough. What concerns us is the divergence between these two cyclical markets. Is the bond market providing an early warnings of problems to come similar to the forex markets in 2008? We do not believe so- and will explain our reasonings on the following page- but it still makes sense to watch out for the kind of collapse in the commodity currencies that hit 10-year yields in November of 2008.

Equity/Bond Markets

Just below is a chart of the S&P 500 Index, 30-year Treasury yields, and the Fed funds policy rate from October of 2002 through August of 2004.

In sequence the equity market turned higher followed three months later by yields. Roughly twelve months later the Fed began to raise the funds rate.

The point is that falling long-term Treasury yields are only bearish if the equity markets decline. As trite as this may appear it is a reasonable observation. Yields can decline- as they did through the second quarter of 2003- and the stock market can rally. The stronger the stock market’s trend the greater the odds that yields will bounce sharply back to the upside in due course.

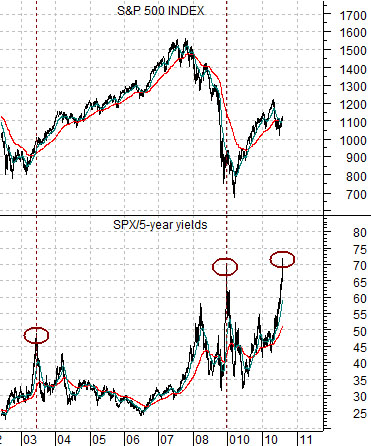

Quickly… below we show the SPX and the ratio between the SPX and 5-year Treasury yields. Notice that the SPX/5-year yields ratio spiked to a peak into June of 2003 and again in December of 2008. In both instances the rapidly rising ratio between equities and yields marked a stock market bottom and an impending low for yields.

Below is a chart comparison between Panasonic (PC) and 10-year Japanese (JGB) bond futures from 2002 into early 2004.

The SPX bottomed in March while Panasonic continued under pressure into late April. The Japanese bond market did not peak until U.S. bonds reached a high in June. The point is that if 2010 is in any way similar to the last bottom for short-term interest rates in 2003 then a period of equity markets strength and falling yields makes sense. As mentioned on page 1 our concern is that falling yields are not a harbinger of a cyclical recovery but are instead a warning shot across that bow indicating the potential near-term demise of the commodity currencies.