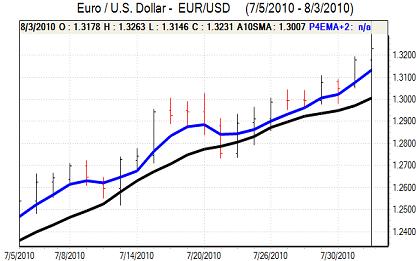

EUR/USD

The Euro retreated to lows near 1.3150 against the dollar in early Europe on Tuesday, but underlying support for the currency remained robust and it moved to challenge resistance levels above 1.32. There was a peak close to 1.3260 before the US open as the dollar remained under pressure.

The US data was slightly weaker than expected, although the impact was limited as they were not major releases. Pending home sales weakened by a further 2.6% for June following a revised 29.9% decline the previous month while factory orders declined by 1.2% for June. Personal incomes and spending were unchanged over the month as the savings rate edged higher and there will be further doubts over consumer spending trends over the next few months.

There were media reports during Tuesday that the Federal Reserve would consider further measures to support the economy at next week’s meeting. This would effectively involve a further loosening of policy through a renewed buying of securities even if Fed funds interest rates were left on hold in the 0.00-0.25% range.

The dollar was again unsettled by speculation over further easing and remained generally on the defensive during the day. Weak risk appetite did fade slightly following the US data and the dollar consolidated in the 1.3225 area. Ahead of next week’s Fed meeting, the dollar will find it difficult to secure much relief.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk conditions were slightly more cautious on Tuesday which provided a degree of protection for the yen, especially after weaker than expected Australian economic data, although profit taking may also have been a feature given underlying doubts over the global economy. There was also some evidence of exporter selling ahead of the holiday season.

Markets will remain on high alert over the possibility of Bank of Japan action to block yen appreciation and this will remain an important market factor. The dollar held just below 86.50 against the yen with resistance levels not coming under threat.

There was a persistent lack of support for the dollar during the day, especially with speculation over Fed easing moves next week and the dollar weakened to fresh 2010 lows close to 85.70 during the US session.

Sterling

There was a slightly more cautious Sterling tone in early Europe on Tuesday. The construction PMI index weakened significantly to 54.1 from 58.4 the previous month and this was a four-month low for the index which will maintain unease over the housing-sector developments.

The services PMI index will be watched very closely on Wednesday and any weak reading could trigger an important reassessment of Sterling sentiment.

The UK currency was able to recoup losses following the data and challenged resistance above 1.5950 before stalling with the trade-weighted index at an 11-month high. There are reports of substantial option barriers in the 1.60 area which may serve to toughen resistance levels.

There will be caution ahead of the Bank of England policy meeting and there is likely to be some speculation over a rate increase which will tend to underpin Sterling to some extent.

Swiss franc

The dollar was unable to make much headway above 1.04 on Tuesday and weakened to test 7-month lows close to 1.0350 before recovering back to the 1.04 area. The Euro moved high to the 1.3750 region with the franc losing some support on renewed interest in high-yield instruments.

Swiss consumer prices fell 0.7% for July to give a 0.4% annual increase which was significantly lower than expected. The weak inflation data will trigger some renewed speculation that the National Bank will harden it stance and consider renewed intervention to curb franc gains which may deter aggressive near-term franc buying.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

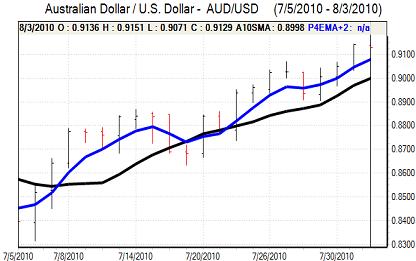

Australian dollar

The Australian dollar was slightly weaker in local trading on Tuesday with a decline in building approvals sapping confidence to some extent while the retail sales data was uninspiring. The Reserve Bank statement following the decision to hold interest rates at 4.50% was broadly in line with expectations and contributed to a slightly softer local-currency tone.

The currency found support below the 0.9070 level and re-tested resistance above 0.91 later in the New York session as the US currency remained under pressure. Markets want to take a positive attitude towards risk, but the difficulties in extending the gains suggests that investors are uneasy over pushing the currency sharply higher.