Our last Beige Book was June 9th and we liked that one. My comment to Members at that time was:

Our last Beige Book was June 9th and we liked that one. My comment to Members at that time was:

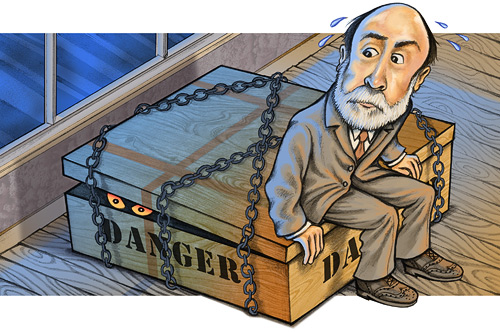

Wow, this is good stuff! Ben was not BS’ing – It’s a slow, tedious recovery but a recovery nonetheless! On the whole, a pretty good report! Not enough to support $75 oil but a nice, not too inflationary recovery is in the works. It’s no quick fix though, as it will take 2 good Qs before corporations will be willing to add staff so I bet not much until next spring unless the government steps in (and they’d better).

At the time, the S&P was at 1,055 and we flew up to 1,120 on June 21st before the next market flip-flop, which we have just flip-flopped back from and yesterday we tested 1,120 again and here we are, back at the Beige Book. So now, the market is about where it should have been based on the last BBook (and no government help so far). I thought yesterday was too early to pop through ahead of the data and it turns out it was. If anything, I’m a lot more worried that a deteriorating report tanks the markets this afternoon (2pm release).

We’ll get a clue this morning as we see Durable Goods at 8:30 and those are expected to be up 1% from down 0.6% in May. Oil Inventories are reported at 10:30 and don’t expect demand to be picking up and no one has even mentioned what a disaster this is during summer driving season (speculators are circling their tankers one more time as they pray for hurricanes to make their long bets pay off). If we do survive the BBook this afternoon, we have a 10% upgrade to Q2 GDP to look forward to tomorrow morning (to 3% from 2.7%) along with Chicago PMI at 9:45.

We know that Leading Economic Indicators turned down 0.2% since the last BBook, the Philly Fed has dropped from 21 in May to 8 in June to 5.1 in July, Construction Spending fell 0.2% with Commercial far worse than Residential, ISM fell almost 6% with a 10% drop in orders leading the downturn and a very deflationary prices paid, Factory Orders in general were off 1.4% (which does not bode well for today’s Durable Goods), Auto Sales slumped 5%, Non-Farm Payrolls contined to decline, Consumer Credit continued to shrink, Industrial Production slipped and Retail Sales dipped another 0.5% – so GOOD LUCK getting a good…

We know that Leading Economic Indicators turned down 0.2% since the last BBook, the Philly Fed has dropped from 21 in May to 8 in June to 5.1 in July, Construction Spending fell 0.2% with Commercial far worse than Residential, ISM fell almost 6% with a 10% drop in orders leading the downturn and a very deflationary prices paid, Factory Orders in general were off 1.4% (which does not bode well for today’s Durable Goods), Auto Sales slumped 5%, Non-Farm Payrolls contined to decline, Consumer Credit continued to shrink, Industrial Production slipped and Retail Sales dipped another 0.5% – so GOOD LUCK getting a good…