Monday brought the market dismal volume but a lift to continue Friday’s move. The market closed on the highs after a slow climb up on very light volume. The range was tight and restricted throughout the day, no robust moves, just slow and narrow. The TRIN closed very bullish at .55 and the VIX at 22.73 just under the 200dma (23.38). The lowest close since May 3rd. Gold closed down $4.00 to $1183.80 and oil closed unchanged at $78.98 a barrel.

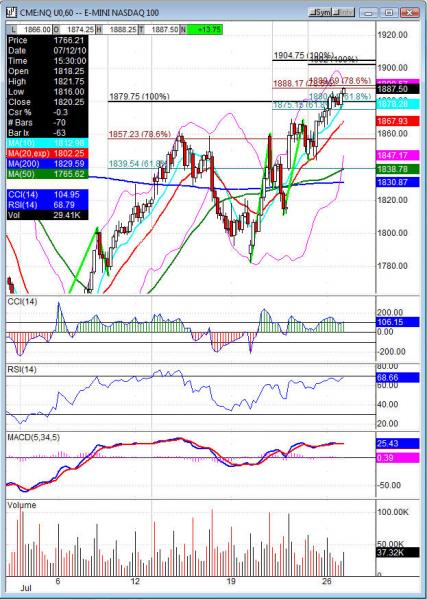

The ES cleared 1102.50 and moved up to 1111.75 closing on the highs of the day. Now we look to move onto 1127.50 the 6/21 day session high and 1129.50 globex high. Then we are a hop skip and a jump away from 1131.75 61.8% fib resistance. The NQ broke 1887.25 and move onto 1888.25 on the day. Now we look for a move to 1938.75 day session high on 6/21 and globex at 1941. No test of the daily or weekly pivots for any of the indexes. That is unusual and we look for those to test into Tuesday, however the weekly are going to be more of an effort to get that low.

The market does need a pullback off this slow lift and a gap up is likely to give us that entry on a pullback on the markets. A pullback would give us the fuel to continue onto the levels listed above. Without a pullback the volume will continue to disappear and leave us in a crawl with no real participation. This is end of month and that leaves us to look for volume to pick up into the weeks end. The market does have reason to pullback here with the divergence and overbought intraday conditions we closed with.

Economic data for the week (underlined means more likely to be a mkt mover): Tuesday 9:00 S&P/CS Composite, 10:00 Consumer Confidence, 10:00 Richmond Manufacturing Index. Wednesday 8:30 Core Durable Goods Orders, 10:30 Crude Oil Inventories, 2:00 Beige Book. Thursday 8:30 Unemployment Claims, 10:30 Natural Gas Storage. Friday 8:30 Advance GDP, 8:30 Advance GDP Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market AKS, BP, CIT, DPZ, DD, ECL, LLL, LVLT, LXK, LMT, NDAQ, OXY, OXPS, SAP, TEVA, X, UA, VLO, and after the bell AET, BRCM, CEPH, DWA, IGT, MEE, NSC, PNRA, ULTI. Wednesday pre market BA, COP, GLW, GD, IACI, IP, LAZ, MHO, MSO, NEM, OSTK, PCAR, PFCB, SO, S, SU, WLP, and after the bell AEM, BMC, DRYS, ESRX, FARO, GG, HURN, LRCX, LOGI, LSI, MYL, OII, PMTC, PDLI, QLTY, RYL, TER, VAR, V, WLT, WCAA. Thursday pre market ADP, BG, CELG, CME, CL, SRAY, DPS, XOM, K, MOT, PTEN, POT, PDE, SNE, LUV, TSM, TNC, TYC, WM, WYNN, and after the bell AMGN, AMCC, CSTR, DSCM, FSLR, GPRO, KLAC, MXIM, MFE, MET, QSFT, RNWK, SUN, VSEA. Friday pre market CVX, CVH, FO, ITT, MRK, GAS, UPL, WY and nothing after the bell

NQ (Nas 100 e-mini) Tuesday’s pivot 1880.50, weekly pivot 1844.50. Support: 1880.50, 1875.75, 1871.50, 1866.25, 1861, 1857, 1853.50, 1847.75. Resistance: 1888.25-1889.75, 1900.50, 1904.75, 1911.25, 1916.75, 1937.50-1938.75