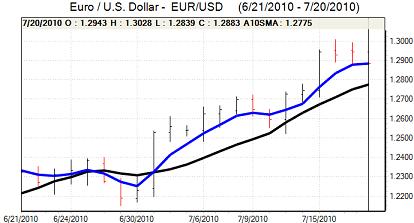

EUR/USD

The Euro spiked higher in European trading on Tuesday and pushed to fresh 10-week highs above 1.3020, helped in part by higher than expected German producer prices. The move above 1.30 was short-lived, however, and there was an initial retreat back to the 1.2930 area.

There was a weak Hungarian debt auction which tended to undermine Euro sentiment to some extent following the setback on IMF talks on Monday. There was some wider negative impact on the Euro with fears that there would be a contagion effect on weaker Euro-zone economies such as Greece and Spain.

The US housing starts data was weaker than expected with a 5% weekly decline to an annual rate of 0.55mn, but there was a monthly gain in permits which helped cushion the impact. There will still be unease over the US economic trends with persistent speculation that there will be a deterioration in conditions. In this context, the comments from US Federal Reserve Bernanke will be watched closely on Wednesday. There will be a further erosion of yield support if there are generally downbeat comments from the Fed chief.

The Goldman Sachs earnings data was weaker than expected which undermined risk appetite to some extent, although the impact was measured and equity markets attempted to rally. The Euro found support below 1.2850 against the dollar and rallied to around 1.29 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During Tuesday, markets continued to speculate over additional central bank action to curb yen gains. The Asian Development Bank (ADB) also issued more optimistic forecasts for the Asian economy which lessened defensive yen demand to some extent.

The yen lost some ground on the crosses, but the US currency was unable to make significant headway amid expectations of further weakness surrounding the US housing sector and there was further dollar resistance close to 87.20.

The dollar proved resilient at lower levels with the yen still damaged by speculation that the Bank of Japan would take action if the yen strengthened further. The US currency found solid support below 87 and pushed to a high around 87.40 later in New York.

Sterling

Sterling was initially able to edge back towards 1.5280 against the dollar on Tuesday as the US currency was generally weaker, but it was put back on the defensive by weaker than expected data.

The UK government borrowing requirement rose to GBP14.5bn for June compared with expectations of around GBP13bn. The data reminded markets over the very serious budget situation and the difficulties in bringing the shortfall under control.

The latest housing data was also weaker than expected with a dip in mortgage approvals for June and this reinforced unease over the second-half economic prospects. There was a mixed CBI report with orders at a six-year high which did not have a substantial impact.

Sterling weakened to a low close to 1.5150 against the dollar, but then found buying support with evidence of solid corporate demand. Sterling found support weaker than 0.8520 against the Euro and strengthened to 1.5280 against the dollar as risk appetite also improved. A tough set of Bank of England minutes on Wednesday would provide further near-term support for Sterling.

Swiss franc

The dollar found support close to 1.0450 against the franc on Tuesday and tested levels just above 1.0550, but it was unable to break resistance levels. The dollar was hampered by renewed franc gains on the crosses with the Euro tested support close to 1.35 before a rebound to 1.3560.

There was a monthly increase in the Swiss trade surplus which provided some underlying franc support with reduced fears that exporter competitiveness was at risk.

Franc volatility is liable to remain higher in the short term, especially with further uncertainty surrounding the Euro-zone stress tests.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

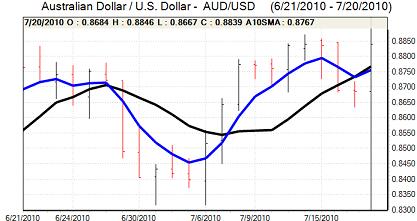

Australian dollar

The US dollar was generally weaker on Tuesday and this allowed an Australian dollar rally to the 0.88 area in local trading as equity markets were also firmer. Overall confidence in the global economy is liable to remain fragile which will lessen the potential demand for the Australian currency.

A resumption of selling pressure triggered a low close to the 0.87 level in late Europe, but a rally on Wall Street and higher commodity prices pushed the Australian dollar back to 0.8830 later in US trading.