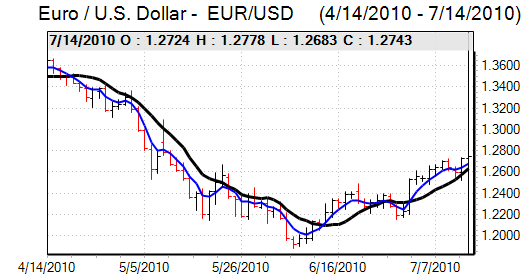

EUR/USD

The Euro found support below 1.27 against the dollar in European trade on Wednesday and ranges were generally narrow with a consolidation of gains seen over the previous 24 hours.

The Euro was able to resist selling pressure as underlying sentiment towards the currency remained slightly stronger while there has been some tentative evidence of renewed longer-term inflows into the currency. Fitch commented that Spain’s credit-rating outlook was stable and this also helped underpin sentiment towards the currency. There will still be the risk that confidence will erode rapidly again, especially if forthcoming growth data disappoints.

The US retail sales report was slightly weaker than expected with a headline 0.5% decline for June after a revised 1.1% decline the previous month while underlying sales dipped by 0.1%. The report will maintain some degree of unease over the US economic outlook and the dollar will continue to be vulnerable on reduced yield support.

The FOMC minutes from June’s meeting also registered a slightly more negative tone with comments that the economic outlook remained relatively modest while the risks were tilted to the downside. These comments will reinforce speculation that the Fed could be forced into additional measures to support the economy later this year.

The Euro pushed to fresh 2-month highs above 1.2770 during the US session as markets looked to break resistance levels and trigger stop-loss Euro buying. Risk appetite tended to falter slightly later in the session and the Euro retreated to the 1.2730 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

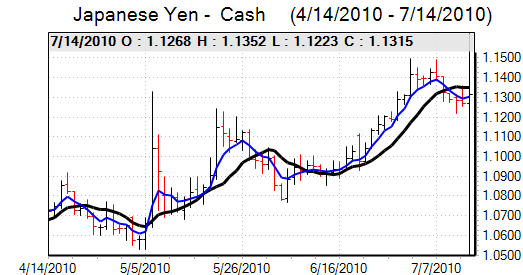

Yen

The trend towards stronger risk appetite was maintained in Asian trading on Wednesday following a favourable quarterly report from technology company Intel.

The Australian dollar maintained a firm tone which sustained interest in carry trades. The dollar tested resistance levels just above the 89 area against the yen while the Euro also pushed to a 3-week high The improvement in risk appetite was also illustrated in yen losses against Sterling, but there is still likely to be some reluctance in selling the yen aggressively.

With the US currency struggling for any traction, there was a dollar retreat to near 88 during the US session with the yen also securing some respite on the crosses. The yen could gain some fresh support if there is disappointing Chinese growth data in Asian trading on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Sterling

There was a decline in the latest Nationwide consumer confidence reading which was in line with expectations and had only a limited impact with Sterling testing 10-week highs above 1.5220 against the US dollar in early Europe on Wednesday.

The latest unemployment count data was slightly stronger than expected with a further decline of close to 21,000 in claims for June. In contrast to recent months, the ILO unemployment report was also stronger than expected with a decline to 7.8% from a revised 8.0% previously. The employment data was significant in boosting confidence in the economy and helped push Sterling to fresh 10-week highs near 1.53 against the dollar.

Sterling also benefited from an improvement in risk appetite, but there was a slightly more cautious tone later in New York and this pushed Sterling back towards 1.5250. There was persistent commercial-bank interest in buying Sterling against the Euro which helped cushion the currency against the dollar.

Swiss franc

The dollar was blocked close to 1.0620 against the franc on Wednesday and retreated to re-test support below 1.0550 later in the US session. The Euro was able to maintain the former tone against the franc seen this week and it pushed to challenge resistance levels above 1.34 even though progress for the currency was limited.

An easing of sovereign debt fears surrounding the Euro-zone economies will tend to curb defensive franc demand to some extent, although the overall impact is still liable to be measured at this stage. Wider unease over the global economy should help protect the franc from heavy selling.

Australian dollar

An improvement in consumer confidence provided some near-term support and there will be underlying confidence in the domestic fundamentals which will also support the Australian dollar.

The currency was able to take advantage of a weaker US currency trend and pushed to a high around 0.8870 during US trading.

There was some commercial interest in selling the currency and it retreated significantly from its best level as equity markets stalled. There was also a further decline in international freight rates which will trigger some fresh doubts over the global economy and is liable to curb Australian dollar buying support.