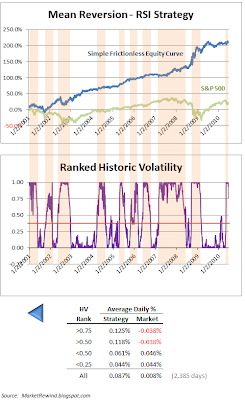

It is simple intuition that mean reversion systems should outperform during periods of greater volatility when higher noise levels permit stronger relative returns. In an attempt to quantify the level of comparative returns, this study segregates average daily returns for a simple, well known Relative Strength Index (RSI) strategy as our mean reversion proxy according to varying levels of ranked Historic Volatility (HV).

By ranking HV, we are provided with a responsive window of relative volatility that is far superior to fixed level analysis, as follows using the S&P 500 SPY Exchange Traded Fund as our trading vehicle:

As shown, the long-short strategy outperformed slightly in all environments on a frictionless, simple/ non-compounded basis. However, as volatility rose to upper traunches over the 2,385-day study period, the comparative level of daily edge increased significantly. Indeed, as expected, daily buy-and-hold returns actually went net negative past the median point.

However, as traders it’s a goal to maximize returns per trade and strategy returns would have undoubtedly been significantly diluted by trading costs as volatility fell. Therefore, one can imagine a creative strategy that emphasizes mean reversion systems as volatility rises and vice-versa favoring long-side holds as volatility falls towards its lower quartile.

By the same token, it’s important for new traders to recognize that mean reversion strategy returns can themselves be on the margin and volatile on days like today when the market is down a couple hundred points. Can you guess what buy/sell signal the proxy system is on today?

[Relative Ranked Volatility has been added to the nightly ETF Rewind dashboard.]

Never Investment Advice