EUR/USD

Banking-sector fears remained an important focus during Friday with fears that there would be a further deterioration in funding conditions which would tend to trigger further selling pressure on the Euro.

There was a further widening of Greek default swaps during the European session before some improvement in confidence later in New York which also helped stabilise Euro sentiment.

The US economic data failed to have a significant impact during the session. The first-quarter GDP estimate was revised down to an annualised 2.7% from 3.0% previously as consumer spending estimates were also lower. In contrast, there was a small upward revision to the University of Michigan consumer confidence index which offered some degree of reassurance over spending trends.

G20 comments on the global economy will be watched closely over the weekend and any signs of division over policy or increased fears over the global economy would tend to have a negative impact on risk appetite.

There was, however, a tentative improvement in risk appetite in US trading on Friday as commodity prices also rallied. The Euro also found further technical support close to 1.2250 and there was a rally to highs near 1.2395 as there was a covering of short speculative Euro positions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Chinese yuan appreciated to a post-revaluation high during Friday which provided some degree of support for the yen, although the impact was limited. The Euro tested technical support close to the 110 level against the yen.

Risk appetite was still fragile on Friday and there was a further decline in the Australian dollar which discouraged carry trades and also provided some degree of yen protection. The dollar was able to hold above 89.20 against the yen on speculation that there would be semi-official buying to block yen appreciation.

The yen weakened to lows near 89.75 on unease over the Japanese debt outlook, but the dollar was unable to sustain gains as it was hampered by wider losses in the markets.

Sterling

Sterling came under pressure in European pressure on Friday with lows near 1.4850 against the US dollar.

There was renewed support during the US session with a rally back to the 1.50 area. Underlying confidence in the UK economy remains stronger with greater confidence in the medium-term credit-rating outlook.

A stabilisation in risk appetite also helped underpin Sterling as the financial sector was able to regain ground. Sterling will still be vulnerable to renewed selling pressure if there are renewed fears over the banking sector.

There was further position adjustment later in New York on Friday and Sterling pushed to highs near 1.51 as the US dollar came under further pressure. Given potential uncertainty over monetary policy, there is also the risk of high volatility during the next few weeks.

Swiss franc

The Euro was subjected to renewed selling pressure during Friday as it lost support near 1.35 against the Swiss currency. Swiss franc strength on the crosses, allied with a general retreat in the US currency, was a very negative influence on the dollar and it weakened to June lows near 1.0925 in New York.

In its quarterly bulletin, the National Bank reinforced the message that deflation was no longer an issue for the economy at this time. The comments reinforced expectations that the National Bank would not intervene in the market and this triggered renewed Euro selling against the franc.

There will still be some degree of franc support from an underlying lack of confidence in the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

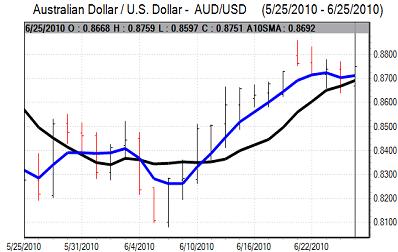

Australian dollar

The Australian dollar declined to lows just below 0.86 against the US dollar during European trading on Friday as underlying sentient remained weak and there was renewed selling pressure on commodities which pushed the Australian currency weaker.

There was a reversal in US trading as commodity prices attempted to stabilise and the Australian dollar rallied to highs above 0.8750 with wider gains for non-US currencies.