Wednesday delivered a lackluster day across the broader markets with the COMPX, NDX and SPX slightly lower and the Dow slightly higher. Overall it was very quiet and didn’t change much from Tuesday’s action. Such a neutral day on a Fed day is just unusual and winding this market for a move. The volume was about equal to Tuesday’s on the NYSE and Nasdaq. Futures were modestly lower across the contracts. The TRIN closed at 1.14 slightly bearish and the VIX at 26.91. Gold closed down $6.20 to $1234.60 and oil was down $1.28 to $76.57 a barrel.

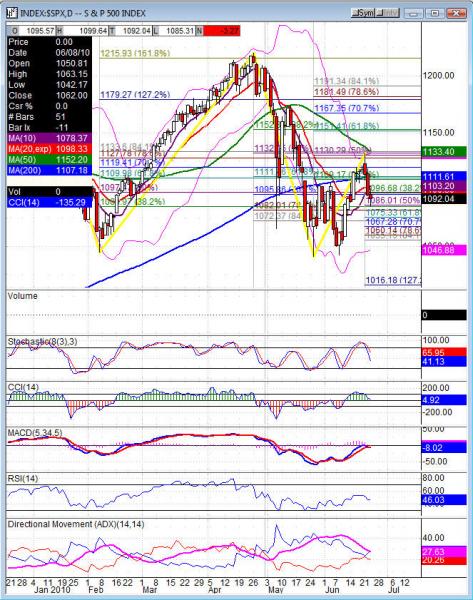

I cannot remember a time when we’ve had a Fed day when volume was not big, the range wasn’t expansive and volatility increasing. The VIX closed with a doji right into the 10dma. The Nasdaq Composite closed just over the 200dma with a hammer just under 2264.49 38.2%, the NDX right on 1869.81 38.2% support, SPX fell under 1096.68 38.2% and the Dow tested and held 10274.60 38.2% support. Into Thursday we are likely to see those levels again. We will either break on the NDX and Dow to move off the support or we’ll see the SPX and COMPX climb back over to avoid confirming the break they had today.

Data continues to roll out into Thursday. So far the week has seen a lot of disappointing data. I will look for some early upside into Thursday’s opening. The ES into 1098.25, NQ 1888.75 and the TF 650.20 should be watched for. That is a good magnet for the bulls to get a bounce across the markets. If the bulls can’t climb through that resistance I don’t see any follow through and nothing more than an orderly bounce getting delivered before we continue lower.

Economic data for the week (underlined means more likely to be a mkt mover): Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:30 Natural Gas Storage. Friday 8:30 Final GDP, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market DFS, LEN, MKC and after the bell FINL, HRB, ORCL, PALM, RIMM, SMSC. Friday pre market AZZ, KBH and nothing after the bell.

SPX (S&P 500) closed -3.27 at 1092.04. Support: 1086.01, 1075.33, 1060.14. Resistance: 1102.85-1111.61 200dma, 1130.29-1133.40 50dma, 1151.41