June 17 (Bloomberg) — U.S. stocks rose as a late-day rally in technology, consumer-staples and industrial companies helped the market overcome an early slump spurred by economic reports that cast doubts on the strength of the recovery.

June 17 (Bloomberg) — Treasuries rose, pushing two-year yields to a three-week low, as reports showed an unexpected jump in jobless-benefit claims and a drop in consumer prices, spurring bets the Federal Reserve will keep interest rates low.

Our bullish thesis rests in large part on rising interest rates so any day when yields drop as quickly as they did yesterday makes for a nervous session. Equities managed to close slightly better however.

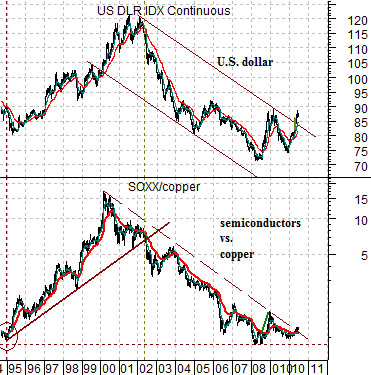

Below is a comparison between the U.S. Dollar Index (DXY) futures and the ratio between the Philadelphia Semiconductor Index (SOX) and copper futures.

We have shown this comparison many times over the years but the basic point is that when the dollar is stronger the chip stocks will do better than base metals prices. Given that the dollar has been stronger… it is no surprise that the SOX/copper ratio is starting to resolve to the upside.

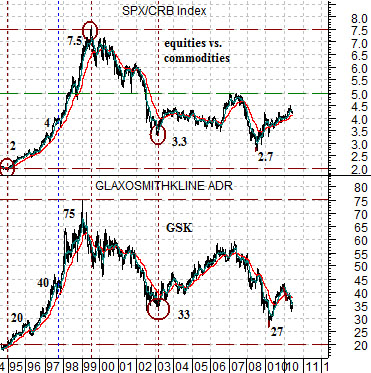

Below is a comparison between the ratio of equities (S&P 500 Index- SPX) to commodities (CRB Index) and the share price of pharma company GlaxoSmithKline (GSK).

The trend from 2000 through 2009 included a weak dollar, a falling SOX/copper ratio, and a declining trend for the ratio between equities and commodities.

The argument is that as the dollar turns higher the trends within the markets change as new themes begin to emerge.

Over the years the share price of GSK has managed to hold quite close to the SPX/CRB Index ratio (i.e. a ratio of 2 would go with a share price of 20 etc.). With the ratio trending upwards in response to a rising dollar the back drop appears to favor many of the large cap names that have languished since the end of 1990’s.

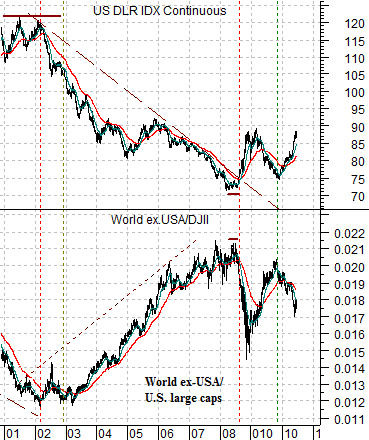

To continue with our page 1 argument we show at top right a comparison between the U.S. Dollar Index futures and the ratio between the Morgan Stanley World ex-USA Index and the Dow Jones Industrial Index (DJII).

The World ex. USA Index divided by the DJII represents ‘everything else’ versus U.S. large caps. Notice that as the dollar declined through the previous decade ‘everything else’ outperformed. At the very least it shouldn’t be too big of a stretch to argue that a stronger dollar either benefits U.S. large cap names or, conversely, acts as a negative for the BRIC/Asian/Latin/commodity themes that have rewarded investors over the past number of years.

Another view is shown below using the cross rate between the yen and euro and the ratio between the S&P 500 Index (SPX) and NYSE Composite Index.

The SPX/NYSE Comp. ratio represents large cap versus small cap. Similar to the other relationships shown the trend began to favor the smaller cap names back in 2000 following the peak for the SPX and Nasdaq. Now that the dollar is rising and the yen is pushing higher against the euro the trend has reversed as the SPX/NYSE Comp. ratio resolves higher.

Our point is that with the dollar trending upwards there is only one bullish outcome- U.S. large cap stocks which are outperforming small caps and foreign markets have to rise in price. If the relative strength leaders do not rise… then we are facing the same situation as the back half of 2008 all over again.

Below we compare IBM and Coca Cola (KO). We have been focusing on IBM in recent weeks because it is very close to its major resistance line. If IBM were to break above the highs set in 1999 and 2000 then the prospect of a bullish outcome and actual gains in many of the stocks which have languished over the last ten years increases substantially.