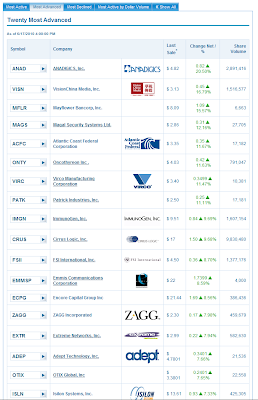

I go to the nasdaq.com page once market is closed and check the most unusual volume list charts, then 20 most advanced and most declined lists (it used be 10 most list before).

It´s very teachfull to check those companies with hourly and daily charts plus it gives a lot of ideas. Specially if you deal with EW and EW patterns, one particular pattern I did master via this is ending diagonals and this is the right place to be with that pattern as it is major reversal pattern. Of cource my contracting triangle is on there also reasonable often.

While Nasdaq itself have approximately ~3800 listed companies most often those company names can be something you never have even heard of.

My warm recommendation for you to do the same – to learn read actual charts itself what was the situation before progressive movements.