EUR/USD

The Euro again found support close to 1.19 against the dollar on Tuesday and made an attempt at breaking back above resistance in the 1.20 area.

The German industrial data was again stronger than expected with a 0.9% monthly increase, but this failed to have a major impact as any positive impact had been reflected by the orders data on Monday. Buying support generally remained dependent on short covering and wider position adjustment with little evidence of significant support for the Euro.

Yield spreads on Euro-zone bonds failed to narrow significantly as underlying confidence in the Euro area remained extremely weak. Sovereign debt issues remained a key market focus while there were fears that weaker Euro members could be forced to withdraw from the Euro area. The evidence suggested that Euro policymakers remain uneasy over the pace of the Euro’s decline, but also that there are no significant concerns over the currency’s level. In this environment, there will be market expectations that the Euro will weaken further in the medium term.

Fed Chairman Bernanke made some generally positive comments on global economic trends which helped stabilise global risk appetite to some extent. There was a decline in the latest IDB consumer confidence data which may raise some doubts over future spending trends, but the impact was limited.

The Euro failed to push above the 1.20 level and weakened back to the 1.1940 area later in the US session as equities drifted lower.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest domestic banking-sector data recorded a 2.0% decline in lending in the year to May which will maintain expectations that Japan will need robust export growth to offset the impact of very weak domestic demand and credit. There will be further pressure to maintain a competitive yen and the government is likely to maintain its overall opposition to currency gains.

There was some stabilisation in risk conditions during Tuesday and the dollar edged higher to around 91.80, but was unable to break above the 92 resistance zone as caution prevailed.

Confidence surrounding the global economy remained generally fragile with equity markets unable to make significant headway and the dollar dipped to test lows before rebounding back to around 91.30 as there was still solid dollar buying support on dips.

Sterling

Sterling edged higher on Monday with an improved BRC retail sales report helping to stabilise confidence, but there was significant resistance above the 1.45 level against the US dollar.

In comments on Tuesday, ratings agency Fitch warned that the UK government faced formidable challenges over fiscal policy and that speedy cuts in spending levels were required to stabilise the deficit position. To some extent the report held no new information as the government itself has already warned that there needs to be greater than expected spending cuts. The remarks still triggered significant selling pressure on Sterling and there was a decline to important support levels close to 1.4350 before a rally back to above 1.44 later in New York.

The Euro strengthened back above 0.83 from 18-month lows seen on Monday. The UK currency will remain vulnerable to concerns over a possible credit-rating downgrade, although the potential negative impact will be offset by expectations that difficulties are even worse within the Euro-zone.

Uncertainty over the Bank of England’s monetary policy will maintain the potential for erratic Sterling moves ahead of Thursday’s MPC policy meeting.

Swiss franc

The dollar hit resistance close to 1.1640 against the franc on Tuesday and weakened sharply to test support levels below 1.15 before stabilising above this level. Cross-market moves remained an extremely important influence during the day.

Initially, the Euro weakened to test fresh record lows below 1.38 against the franc before rebounding strongly to near 1.39 in very volatile trading conditions. There was strong speculation that the National Bank had intervened to weaken the franc, although the bank, as usual, declined to comment on the speculation.

While sovereign debt fears remain important within the Euro-zone, there is unlikely to be strong selling pressure on the Swiss franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

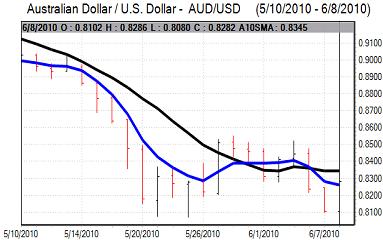

Australian dollar

The Australian dollar found support below 0.81 against the dollar on Tuesday and secured firm gains during the day with a peak above the 0.8280 level. There was some evidence of bargain hunting during the session after a succession of heavy losses during the past few days.

Underlying risk appetite is likely to remain fragile in the short term and the Australian dollar will be vulnerable to renewed selling pressure if there is a sustained decline in commodity prices.