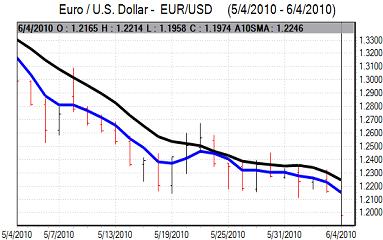

EUR/USD

The Euro drifted weaker in early Europe on Friday and was then subjected to heavy selling pressure ahead of the US open as structural fears returned to undermine the currency.

There were reports that the French Prime Minister had stated that Euro at parity against the dollar would be good news. These comments were denied, but there was still an important loss of confidence in the Euro.

The new Hungarian government stated that the economic situation was grave and claimed that the previous administration had issued false information. There were also comments that a default was a possibility given the underlying economic situation.

These comments fuelled renewed fears over the structural outlook and there was a sharp widening of Euro-zone debt spreads with renewed unease over countries such as Spain and Portugal. There was renewed selling pressure on the Euro due to fresh speculative selling and capital outflows. The Euro lost support at the previous 4-year low just above 1.21 and weakened to a low near 1.2050 on stop loss selling ahead of the US employment data.

The headline US employment report was weaker than expected with an increase of 431,000 in employment for May which was the highest increase for over 10 years. A very high proportion of the gains were due to government hiring for the census and the increase in private-sector payrolls was limited to 41,000 compared with expectations of a 190,000 gain. The data may cast some doubts over the strength of the US economy, but there will still be expectations that it will out-perform the Euro-zone area.

Risk appetite still deteriorated following the data, especially as there was a sharp decline on Wall Street and the Euro weakened to fresh lows below 1.20 against the dollar as selling pressure persisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Finance Minister Kan was confirmed as the new Prime Minister on Friday and this is likely to unsettle the yen on expectations that the administration will push for a weaker Japanese currency. The dollar nudged resistance levels above 92.80 on Friday, but was unable to break through this area.

The US currency lost support following the US employment data and weakened to test support below 92 as Wall Street opened sharply weaker. The yen also gained support from new fears surrounding the Euro-zone economy and the threat of capital repatriation.

The dollar came under further pressure later in New York with lows close to 91.50 as US equities remained under pressure.

Sterling

Sterling was trapped below 1.47 against the dollar on Friday and drifted weaker ahead of the US open as European currencies generally lost ground with Sterling testing lows below 1.4550.

Risk conditions continued to deteriorate following the US employment report and the UK currency moves remained correlated with global stock markets moves. As equity markets moved sharply lower, Sterling retreated towards weekly lows below 1.45 against the US dollar.

The Bank of England monetary policy meeting will be very important for market sentiment next week and volatility levels are liable to remain high. The Bank of England will need to sustain market confidence in Sterling and this will be a difficult task.

Swiss franc

Swiss franc volatility surged again European trading on Friday with a further focus on the National Bank actions.

The Euro lost support close to the 1.4050 level during the day and then weakened very sharply to lows around 1.3880 with the assumption that the central bank had stopped intervening. The dollar also weakened very sharply in tandem with a low near 1.1410. The US currency then advanced strongly to a high around 1.1625 in New York trading while the franc stabilised just above 1.39.

The further widening of European credit swaps continued to have an impact in boosting defensive demand for the Swiss currency.

The Economics Ministry stated that there was not necessarily the pain threshold as this was too simple. There will still be pressure for the bank to curb franc gains within Europe.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

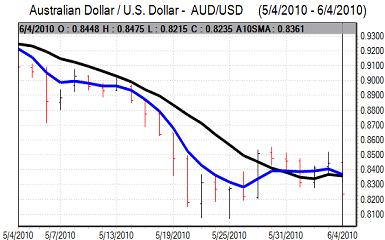

Australian dollar

The Australian dollar rallied back to the 0.8460 area against the US dollar in local trading on Friday. Underlying confidence in the domestic and international economy is still likely to be weaker in the short term and this will limit the scope for Australian dollar buying support.

Indeed, risk appetite deteriorated sharply following renewed stresses in European credit markets. With the US currency also stronger and equity markets under stress, the Australian dollar weakened to lows below the 0.8250 level.