Friday 28 May 2010

The market showed the kind of weakness on Wednesday’s rally we wanted to

see within the down trend to warrant a short position, yet we opted not to follow

it. Previously, this has been a sell signal, but not then. We had already made

a determination that buying was entering the market on the sharp declines,

[See S & P – A Set-Up In The Making, click on http://bit.ly/aLZKzQ, starting with

the second paragraph]. What started as a decline late Wednesday turned into

a huge gap up rally on Thursday.

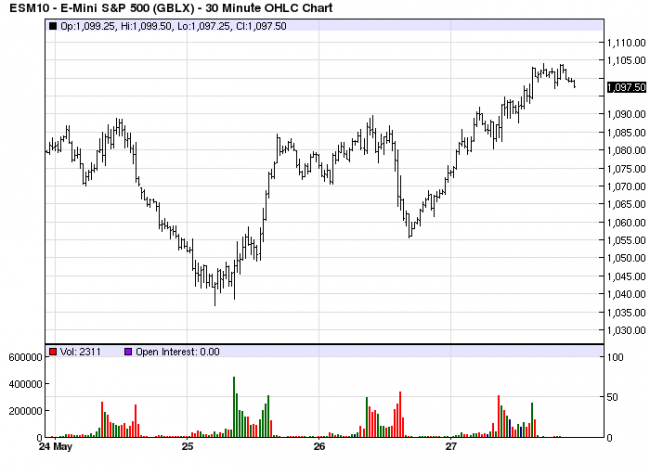

On the chart below, at the close on Wednesday the 26th, there was a change

of volume behavior. Any time a change of behavior develops, it is a red flag.

Coupled with the observation that buyers were entering the market, there was

evidence of buying on the close, and this was the behavioral change. The chart

includes overnight price data, but 3 bars from the low on the 26th is the

highest volume bar, but the net downside gain was minimal, and the low was

not much lower than the wider range bar that preceded it, [4th bar from the

low]. A smaller range on the second highest volume in several days is a sign

that buyers are meeting the effort of the sellers, otherwise, the decline would

be much greater, and that is the red flag mentioned.

There was no indication that a 35 point rally would follow, as it did yesterday,

but the developing market activity gave an indication that some rally may be

possible. You can see from the highs from the 24th and 26th, 1090 was an

area of resistance. Once the day session began on yesterday, and price was

30 points higher, volume was light, and sellers could easily push the market

lower. As long as price stayed above the 1090 previous resistance, and it

would become support if it held, and it did.

An hour and a half before the close, we saw a wide rally bar on increased

volume make new highs, and this confirmed that the 1090 level would now be

support. We took that as a signal to take a long position. The close was near

the high of the day, up 35 points, and that indicates there should be some

upside follow-through on Friday. It may not happen, but that is what market

activity is indicating.

Tomorrow starts a holiday weekend, and prices tend to firm. A higher close

would be a key reversal on the weekly chart, and this supports the contention

that some kind of rally is in the cards. Where and how price closes on Friday

will provide new information, and it will tell us whether to stay long, or not.