When the day comes that the bond market, dollar, yen, and gold prices stop rising we will probably feel somewhat better about the equity markets. Aside from that… we really do have the feeling that we have seen all of this before. 1998 comes to mind as a template.

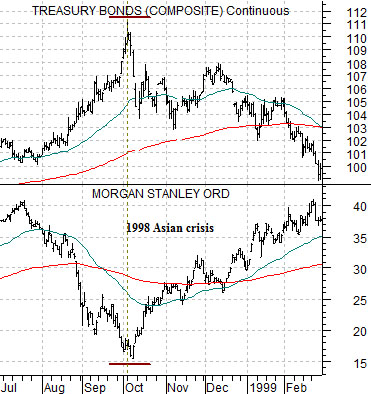

During 1998’s Asian crisis- the one that hammered the equity markets in general and the financials in particular for a couple of months- the offset to tumbling stock prices was a strong bond market. At right we show the comparison between Morgan Stanley (MS) and the U.S. 30-year T-Bond futures from July of 1998 through February of 1999.

Keeping in mind that the drama did not truly end until early 1999 the chart makes the rather simple point that as long as the long end of the Treasury market is ramping higher the stock market will remain under pressure.

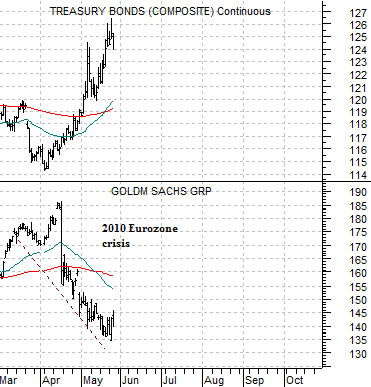

Below we have included a chart of the U.S. 30-year T-Bond futures and the share price of Goldman Sachs (GS). There isn’t any particular reason to use GS here instead of MS- when we have shown this in the past we have used Merrill Lynch for our example- but since GS really seems to have become ‘the market’ these days it should serve our purposes nicely.

The point is that the action between financials and long-term Treasuries through the Eurozone crisis is fairly similar to what happened back in 1998 during the Asian contagion. Our focus of late has been on the bond market for the very simple reason that it only makes sense to consider the long side of the stock market once bonds show some indication of settling out.

If you look at the TBond vs. Morgan Stanley comparison closely you might be able to see that the absolute lows for MS were made a couple of days after the absolute highs for the bond market. Ideally a time will come when bond prices fall far enough to break the rising trend confirmed by weakness in the dollar, yen, and gold.

The good news is that crisis-inspired liquidity holes similar to 1998 tend to break hard and recovery quickly. As an aside the Nasdaq Composite Index fell to around 1400 into October of 1998, passed 2500 during the first quarter of 1999, and peaked around 5000 a year later. In the face of intense ongoing worry and concern there are indeed reasons to be optimistic… once the bond market stops rising parabolically.

Equity/Bond Markets

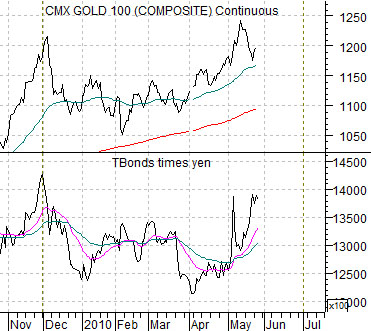

Below is a comparison between gold futures and the combination of the U.S. 30-year T-Bond futures times the Japanese yen.

The argument is that gold, the TBonds, and the yen represent destinations for capital fleeing risk. The charts make the rather tenuous case that a top may already have been made. In other words… as long as these markets are not spiking to new highs a case can be made that the worst has passed.

We are going to return to an argument that we made a few weeks back. On page 1 we suggested that bond price strength is merely the result of capital temporarily fleeing risk and based on yesterday’s argument that the cyclical trend is still very positive… this makes sense to us. An alternate outcome, however, would be something a bit closer to 2000.

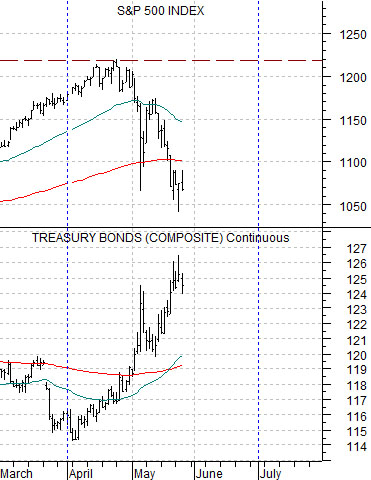

Further below we show the S&P 500 Index (SPX) and the U.S. 30-year T-Bond futures from December 1999 through April of 2000. The Nasdaq reached its cycle peak at the end of March.

When the bond market began to rise in January of 2000 the equity markets broke lower. Strong bonds/weak equities. The sell off continued for a couple of months until the SPX made a bottom in late February before spiking to new highs into the end of the quarter.

Our argument has been that we are still in a strong cyclical trend and that the rise in the bond market and sell off in the equity markets is the result of capital temporarily fleeing risk. The key word here is ‘temporarily’.

In 2000 the stock market shot back to new highs during the final month of the quarter (similar, perhaps, to what might happen in June) but instead of pivoting lower (as was the case in 1998 as well as through March of this year) the long end of the bond market continued to move higher. In other words… while stocks declined in 2000 in response to a rising bond market the message was considerably different than in 1998. In 1998 the bond market ‘said’ that the cyclical trend was alive and well once the crisis had passed while in 2000 the argument was that cyclical growth was actually slowing. What happens later this year may well depend on how the bond market responds if, as, or when the equity markets take a run at the April highs.