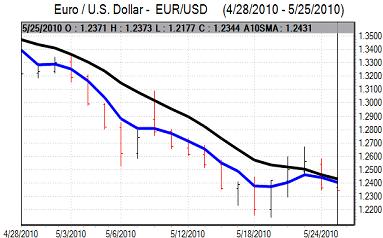

EUR/USD

A sharp decline in Asian stock markets pushed the Euro to lows below the 1.23 level against the dollar as fears over the European debt situation continued.

Selling pressure intensified in European trading with the Euro testing support levels below the 1.22 level which was close to 2010 lows. There were persistent tensions surrounding the Spanish banking sector and there were fears over wider stresses within the European financial sector. The IMF warned that Spanish banks needed an overhaul which contributed to the negative underlying sentiment even though there were no direct links. There were further inter-bank tensions with dollar Libor rates rising to a fresh 10-month high.

There was some speculation over a cut in ECB interest rates which also contributed to speculation that the Euro would be a prime candidate for being used as a funding currency. The Euro-zone industrial data provided some degree of relief with a strong gain for industrial orders in April.

The US consumer confidence data was stronger than expected with a rise to 63.3 for May from a revised 57.7 the previous month. This was the highest reading since March 2008 as there was greater confidence in the labour market. In contrast, the Case-Shiller housing data was slightly weaker than expected with a monthly decline in prices limiting the annual increase to 2.3%.

After heavy opening losses, there was a recovery on Wall Street which helped improve risk appetite and there was also a move to cover speculative Euro short positions. The Euro rallied back to above 1.2350 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite deteriorated further in Asian trading on Tuesday as regional bourses fell sharply. Japanese Finance Minister Kan also stated unease over the European economic fundamentals and debt markets. The comments will maintain speculation over capital repatriation back to Japan which will also tend to support the yen.

The Japanese currency was unable to take full advantage of deteriorating risk conditions as Korean tensions persisted, but the US dollar did decline to the 89.75 area in early Europe on Tuesday as carry trades were scaled back.

The dollar edged lower to 89.25 as equity-market selling intensified, but the dollar avoided a significant test of support and rallied back above the 90 level as risk conditions stabilised.

Sterling

A renewed decline in global stock markets pushed the UK weaker again in Asian trading on Tuesday with lows below 1.43 against the dollar. First-quarter GDP was revised up to 0.3% from the preliminary 0.2% estimate and this was in line with market expectations which had only a limited market impact.

Trends in risk appetite remained very important with the Sterling coming under fresh selling pressure to lows near 1.4250 when equity-market selling was at a peak. As conditions improved, selling pressure on the UK currency also eased and there was some evidence that short positions were being covered with gains back to above 1.44 against the dollar. With speculative positioning at record levels against Sterling there will remain the possibility of a sharp short-covering rally.

Overall confidence in the fundamentals will remain fragile and any further stresses in the European banking sector could be particularly damaging for Sterling, especially as it would risk a renewed deterioration in domestic credit conditions.

Swiss franc

The dollar pushed to a high near 1.17 against the franc on Tuesday, but was unable to sustain the advance and dipped sharply to lows near 1.1550. The Euro found some support below 1.4220 against the Swiss currency and there was further speculation that the National Bank had intervened to sell the franc.

There will still be reservations over a policy of sustained and aggressive intervention, especially given that Euro holdings have already increased sharply.

Safe-haven demand for the Swiss franc could be unsettled by renewed doubts over the domestic banking sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

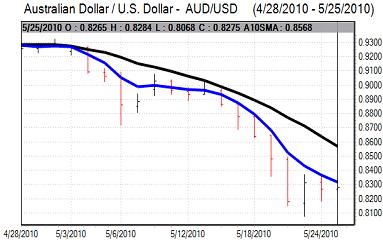

Australian dollar

There was renewed selling pressure on the Australian dollar in Asian trading on Tuesday as risk appetite deteriorated sharply. Stock markets dropped substantially and there was fresh unease over the global economy which discouraged carry trades. The Australian dollar weakened to lows below 0.81 as selling pressure intensified.

There was a strong recovery later in New York trading as equity markets pared losses and there was some interest in bargain hunting. In this environment, the Australian dollar recovered to a high above 0.8250 as volatility remained extremely high.