The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Monday, May 24, 2010

Hours of daily research consolidated for you

An Important Set of Data Points

It is hard to look at long columns of data but please take a moment and go through things line by line. Not really that tough.

|

Market |

14-May |

21-May |

ChangeWK |

%changeWK |

ChYTD |

%ChYTD |

|

Japan-Tpx |

936.45 |

879.59 |

-56.86 |

-6.072% |

-28 |

-3.085% |

|

HongKong |

20,145.43 |

19,434.83 |

-710.6 |

-3.527% |

-1982.17 |

-9.255% |

|

Shanghai |

2696.63 |

2589.52 |

-107.11 |

-3.972% |

-673.48 |

-20.640% |

|

Taiwan |

7772.13 |

7237.71 |

-534.42 |

-6.876% |

-874.29 |

-10.778% |

|

South Korea |

1695.63 |

1600.18 |

-95.45 |

-5.629% |

-32.82 |

-2.010% |

|

Australia |

4611.1 |

4305.4 |

-305.7 |

-6.630% |

-527.6 |

-10.917% |

|

Singapore |

2,855.21 |

2,701.20 |

-154.01 |

-5.394% |

-178.8 |

-6.208% |

|

India |

16,943.34 |

16,445.61 |

-497.73 |

-2.938% |

-898.39 |

-5.180% |

|

|

|

|

|

|

|

|

|

UK-FTSE |

5262.85 |

5062.93 |

-199.92 |

-3.799% |

-375.07 |

-6.897% |

|

Germany |

6056.71 |

5829.25 |

-227.46 |

-3.756% |

-182.75 |

-3.040% |

|

France |

3560.36 |

3430.74 |

-129.62 |

-3.641% |

-529.26 |

-13.365% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DJIA |

10,620.16 |

10,193.39 |

-426.77 |

-4.018% |

-234.66 |

-2.250% |

|

S&P500 |

1135.68 |

1087.69 |

-47.99 |

-4.226% |

-45.3 |

-3.998% |

|

NasComp |

2346.85 |

2229.08 |

-117.77 |

-5.018% |

-78.92 |

-3.419% |

|

NDX100 |

1907.1 |

1822.77 |

-84.33 |

-4.422% |

-64.23 |

-3.404% |

|

R2000 |

693.98 |

649.29 |

-44.69 |

-6.440% |

9.19 |

1.436% |

|

NYSE |

7077.64 |

6775.45 |

-302.19 |

-4.270% |

-551.55 |

-7.528% |

|

Tran |

4487.73 |

4241.59 |

-246.14 |

-5.485% |

110.59 |

2.677% |

|

Util |

379.82 |

361.79 |

-18.03 |

-4.747% |

-37.21 |

-9.326% |

|

|

|

|

|

|

|

|

|

Canada-TSX |

12,014.97 |

11,521.35 |

-493.62 |

-4.108% |

-180.65 |

-1.544% |

|

TSX Venture |

1593.11 |

1453.39 |

-139.72 |

-8.770% |

-100.61 |

-6.474% |

|

Brazil |

63,412.47 |

60,259.33 |

-3153.14 |

-4.972% |

-3036.67 |

-4.798% |

|

|

|

|

|

|

|

|

|

Gold |

1227.8 |

1176.1 |

-51.7 |

-4.211% |

79.1 |

7.211% |

|

Silver |

1920.2 |

1763.1 |

-157.1 |

-8.181% |

68.1 |

4.018% |

|

Copper |

312.3 |

305.15 |

-7.15 |

-2.289% |

-27.85 |

-8.363% |

|

Crude Oil |

71.61 |

70.04 |

-1.57 |

-2.192% |

-5.96 |

-7.842% |

|

Natural Gas |

4.312 |

4.0333 |

-0.2787 |

-6.463% |

-1.7167 |

-29.856% |

|

CRB Index |

258.55 |

251.42 |

-7.13 |

-2.758% |

-33.58 |

-11.782% |

|

|

|

|

|

|

|

|

|

$index |

86.23 |

85.53 |

-0.7 |

-0.812% |

7.58 |

9.724% |

|

Euro |

1.2387 |

1.256 |

0.0173 |

1.397% |

-0.1731 |

-12.113% |

|

Yen |

1.0848 |

1.1141 |

0.0293 |

2.701% |

0.0423 |

3.947% |

|

|

|

|

|

|

|

|

|

VIX |

31.24 |

40.1 |

8.86 |

28.361% |

18.42 |

84.963% |

|

VXN (Nas) |

31.55 |

42.81 |

11.26 |

35.689% |

21.16 |

97.737% |

|

VXV (S&P) |

30.8 |

37.4 |

6.6 |

21.429% |

13.51 |

56.551% |

|

RVX(R2000) |

39.29 |

49.06 |

9.77 |

24.866% |

20.91 |

74.281% |

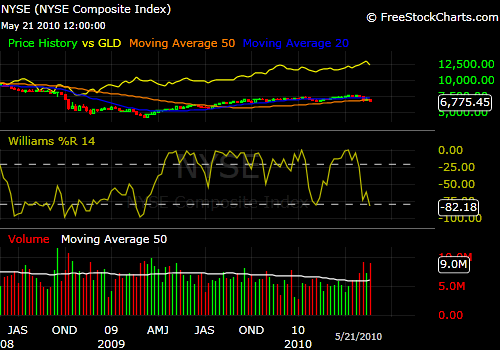

We are only weeks removed from new highs, new bull markets, S&P 1500 calls…after the turmoil with the flash crash, the Euro crises (plural)…and some Fib numbers hit, the market was due for a correction-10-12% is the usual prognosis..over 20% is considered a bear market and Shanghai has arrived there. Will the rest of the markets follow?

The Vix numbers may be indicating more trouble ahead.

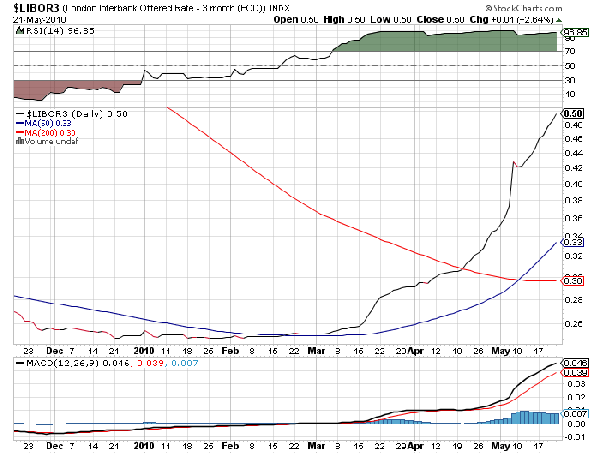

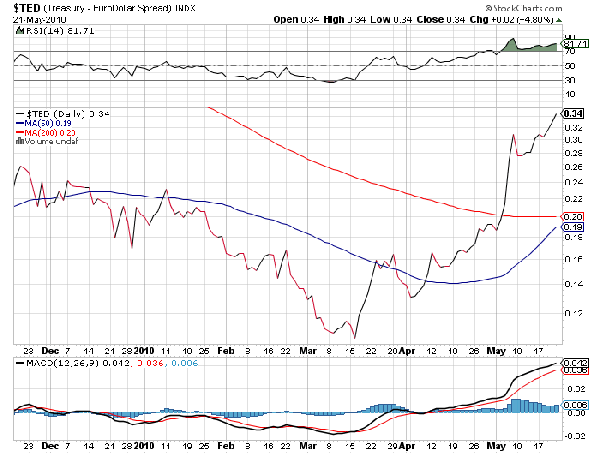

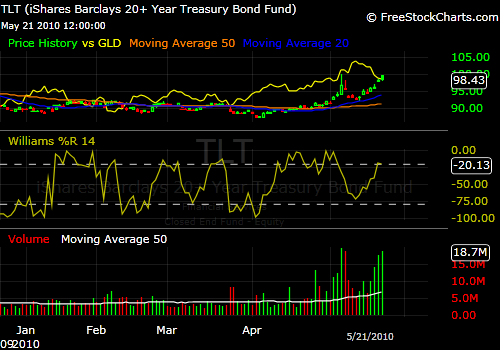

Some of other predictors of more turmoil are the 3 month Libor, the TED spread and the 20year Bond etf.

The 3 month Libor: London Inter-Bank Overnight Rate..rising rates indicates some fear into lending to other banks..hit huge numbers during the Lehman crises…the lower levels on the chart are normal.

From stockcharts.com-an incredible resource.

The TED spread is the rate differential between Treasuries and EuroDollars…like golf, lower is better.

These are steep rises on these two charts that were the key metric watched during the fall of 2008 and into March, 2009 lows..have fallen off the radar screen as “prosperity and a rising bull market” have become the main theme. Pretty good inverse correlation with market action of the past few weeks and steepness of the rising slope. RSI is “overbought” but this indicator can stay there for months and months.

Normally as you are reading this on Monday mornings, Asia has closed its’ opening sessions for the trading week, European markets are underway and there is trading in US futures. This week, I am posting this on Sunday due to travel commitments. My next few days, weeks and months are going to find me on a much different daily, weekly timetable(s) so much timing is going to be adapted accordingly.

That said…this week-end is very, very quiet. Friday was a positive day in the markets with volume, breadth and all kinds of things saying we will get some kind of bounce.

The bonds did well last week and the “flight to safety” is apparent in this chart. Rising prices as investors accepted lower yields and judging by the rising volume bars more people choose to go that route. The bonds even gained some ground against the gold (gld etf), the last few days of the week although gold was overbought, easy liquidity for those needing to raise cash and lots of profits that had been build up. Some sold gold position earlier in the week and started phasing back in after the drop there.

The Vix measurements (see table) are all rising, the Libor3, the TED, rising bonds all indicate the market is going lower.

The bears are vocal again and I have heard projections of a 2500 Dow. When the news is full of negativity and calls of disaster, we often get a bounce in the opposite direction. The shorts ratio below tells you they are not backing up their talk with cash action.

The A & B grade IBD acc/dist numbers continued to decline even with Friday’s big bounce. The DJ shorts ratio which IBD publishes each declined for 15th day in a row…now 9.22…near 14 a month ago.

The NYSE composite..7000 stocks-this is a weekly and has a comparison with the gld (the yellow trendline). Looking oversold but has broken the 20wk and 50 week and is doing so on rising volume.

For subscribers, these charts are crystal clear on the website.

The dollar was actually down a little on the week—the yen screamed upward as trillions were repatriated after Mrs. Watanabe sold positions in all kinds of things to protect gains.

The key for most of us is to determine our time frame of reference. I buy and sell gold and silver stocks (and other things as well) based on expectations for the next few days, few weeks, few months and years in the case of physical metal. The next few days will have different movements than the next few weeks, the next few months and the next few years.

It has been established that institutional money is well over 80% of the totals in the markets. Most of the fund managers whose data is public turn their portfolios 2, 3 and many more times per year trying to all meet the same performance results. Add hedge funds, day traders and other short-term focuses, the only investor left in the world may Joe Johnson of Johnson, MT. Joe was left some shares in a few companies but his father many years ago and never looked at them. He is hoping they are ok.

Joe resides in Johnson, MT and the welcome billboard outside the town reads..Johnson, MT..Mayor Joe Johnson, Sheriff Joe Johnson, Recreation Director Joe Johnson…Population 1…”Drive carefully- the lift you save may be Joe’s”.

The past week have gold take a hit after a nice run-up. Physical gold, I buy on dips when I can..long-term it just keeps going up and so I just keep it. The last 10 years, gold is really the only thing that has done that and it has had some big swings which let’s do pretty well with shorter-term assets like the etf, the miners.

I will see all my grandchildren over the next few days so it is going to be a great week for me no matter what the market is. Gold is good but your kids and grandkids are all the real treasure and the most important thing to be cherished.

The last few week-ends have been full of turbulence and bluster. This one is eerily quiet.

Be alert.

JohnR

Goldensurveyor.com