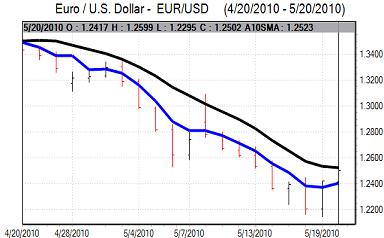

EUR/USD

The Euro was unable to hold above 1.24 in Asia on Thursday as underlying confidence towards the currency remained very fragile.

There was a decline in Euro-zone consumer confidence for May which may cause some unease over potential spending trends. The German IFO data and Euro-zone PMI data will be watched closely on Friday to assess potential near-term trends.

The US economic data was slightly weaker than expected and this tended to have some negative impact on risk appetite which, paradoxically, also provided some degree of US currency support. Initial jobless claims rose to 471,000 in the latest reporting week from a revised 446,000 the previous week. There was a decline in leading indicators for the first time in close to 12 months while the Philadelphia Fed index was also slightly weaker than expected, although it still posted a monthly increase.

Risk appetite weakened following the data as Wall Street came under heavy selling pressure and the Euro weakened to test support close to 1.23. The Euro was undermined by persistent fears over European sovereign-debt fears while there was strong defensive demand for US Treasuries.

Thereafter, trading was again dominated by market rumours. There were rumours of central bank intervention to support the Euro during the US session and there was also some speculation of an extraordinary ECB policy meeting.

These rumours triggered a sharp Euro correction stronger with a high close to 1.26 against the dollar in very volatile trading before a retreat back to below 1.25.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese GDP data recorded growth of 1.2% for the first quarter, but this was weaker than expected and underlying confidence is likely to remain fragile with fears that any Japanese momentum will stall very quickly.

Despite the Euro’s recovery, underlying risk appetite remained fragile with Asian equity markets generally under pressure on unease over the global economy. In this environment, there will be reservations over capital outflows, especially with the Australian dollar falling very sharply. weakened back towards 91.00 against the yen.

Risk appetite deteriorated sharply again in US trading and there was also evidence of carry-trade liquidation, especially in commodity currencies. In this environment, there was renewed safe-haven demand for the yen and it strengthened very rapidly to a high near the 89 level. Markets managed to find some composure later in the session and there was a recovery towards the 90 level.

Sterling

Sterling was unable to sustain the advance above 1.44 against the dollar on Thursday as underlying sentiment towards European currencies remained very fragile. Retail sales rose a headline 0.3% for April which was close to market expectations and did not have a major impact.

The UK currency was certainly unsettled by sovereign-debt fears during the day with the currency also undermined by the high degree of risk aversion with a flow of funds out of UK markets.

Fiscal policy remained an important focus and there was some speculation that there would be further fiscal tightening than expected to compensate for worse than expected budget trends. In this environment, the latest monthly budget data will be watched closely on Friday and a higher than expected deficit would tend to undermine Sterling confidence.

From lows below 1.4250, a wider correction weaker for the US dollar helped pushed Sterling back to above the 1.44 level in US trading. The UK currency weakened to near 0.87 against the Euro.

Swiss franc

The dollar pushed to a high near 1.1580 against the Swiss franc on Thursday, but was unable to make further headway and weakened back to the 1.1480 area in US trading. The Euro was on the defensive against the Swiss currency during the European session, but there was a fresh surge higher in New York with the Euro rallying to a high near 1.4450.

There were mixed comments from National Bank members during the day as Jordan stated that the franc rise was not excessive, but also that the bank was combating aggressively to counter deflationary forces.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

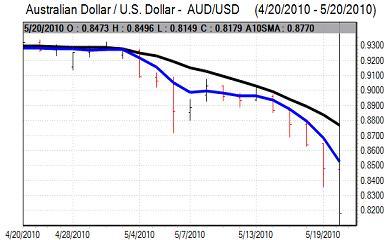

Australian dollar

There was further aggressive Australian dollar selling in Asia on Thursday which pushed the Australian dollar to lows near 0.8250, the weakest level since September 2009. After a brief rally, there was renewed selling pressure during the New York session with a low at 0.8150 before buying support emerged.

Confidence will remain extremely fragile on fundamental and technical grounds, but there was a rally in US trading as there was a squeeze on short positions and the Australian dollar rallied back to the 0.83 area before coming under renewed selling pressure.