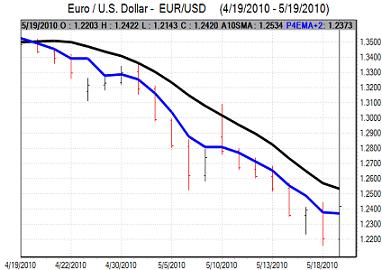

EUR/USD

The Euro re-tested support close to 1.2150 in Asia on Wednesday as confidence remained weak. There were further rumours surrounding the Euro-zone outlook and fears that European governments will not be able to prevent debt defaults. German Chancellor Merkel stated that the Euro was in danger with a policy response needed urgently. The German decision to ban short selling also maintained fears over a lack of unity within the Euro area.

There were a succession of market rumours during the day which contributed to a high degree of volatility. There were rumours that Greece would leave the Euro and this triggered sharp gains for the Euro on expectations that a new hard-currency area could be formed.

There were also rumours of G7 intervention to stabilise currency markets and the Euro was able to secure strong net gains for the trading day as a whole.

The US consumer prices data was weaker than expected with a headline 0.1% decline in prices for April. Core prices were unchanged over the month to give an annual increase of 0.9%. The benign data will maintain expectations that the Federal Reserve will be able to maintain a policy of very low interest rates for an extended period.

The Federal Reserve minutes recorded that the FOMC had upgraded its growth forecasts and was cautiously optimistic towards the outlook even though there was the risk of a negative impact from European difficulties. The members were, however, also still concerned over weak bank lending and difficulties in the credit sector.

The Euro pushed to a high around 1.2425 against the dollar as there was a significant round of short covering.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese data recorded an upward revision in industrial production to 1.2% from 0.3% originally which may provide some degree of support to the economy, although the impact is liable to be limited.

Risk appetite remained very fragile during Asian trading on Wednesday and the US currency dipped to lows near 91.50 as the Nikkei index weakened to a three-month low. The dollar did find support near this level and edged back to the 92 region as underlying yield considerations remained negative for the Japanese currency.

There was renewed volatility for the Japanese currency over the remainder of Wednesday with the dollar dipping to lows below the 91 level before a recovery back to 91.75 later in the US session.

Sterling

The UK currency tested 13-month lows just below 1.4250 against the dollar on Wednesday before staging a limited corrective recovery. The MPC minutes from the May meeting recorded a 9-0 vote for unchanged policy. There were mixed views on the economy by members with some uneasy over the inflation developments while others were focussed more on the growth risks.

The divergence of views will tend to reinforce policy uncertainty and will also tend to contribute to Sterling volatility. The net expectations are still that the bank will have a bias towards maintaining low interest rates.

Sterling was generally under pressure when risk appetite deteriorated while there was a tentative recovery in currency demand when conditions improved.

A wider corrective recovery for European currencies pushed Sterling back towards 1.4450 while the UK currency weakened to lows beyond 0.86 against the Euro.

Swiss franc

The dollar secured net gains against the Swiss franc during the day with a move to fresh 12-month highs. The trigger for dollar moves was a very sharp franc move on the crosses as the franc weakened very sharply.

There was evidence of sustained Euro selling early in the European session, but the flows reversed sharply in US trading with evidence of very heavy and sustained National Bank intervention. In this environment, the Euro strengthened rapidly to a high close to the 1.43 level against the Swiss currency from 1.40 with the Euro able to hold the bulk of the gains in very volatile trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

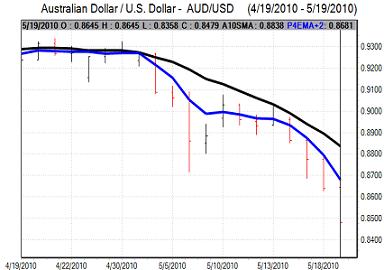

Australian dollar

The domestic data recorded a decline in consumer confidence to the lowest level for 12 months which unsettled sentiment towards the Australian economy. The currency dipped to lows below 0.8500 in Asia on Wednesday as wider risk appetite remained weaker.

The currency came under heavy selling pressure later in the European session with a low close to 0.8350. The currency did rally firmly later in the session, but the commodity currencies generally underperformed as confidence in international growth prospects remained slightly weaker.