By: Macro-Trader

Last week, I expressed my belief that the market was likely to stall at overhead resistance and turn lower resulting in a fill of Monday’s gap at a minimum. For the better part of last week, markets experienced a short covering rally until more Eurozone concerns surfaced late in the week. This brought on another bout of strong selling pushing index futures well into the depths of Monday’s gap. This leaves us with the likely-hood that a successful fill is just on the horizon.

The next level of support after a gap fill of 1107 in the ES contract is the 200 day ma’s (ema/sma) residing around 1091-1094 in the ES and 1100-1103 in the S&P 500 Cash. Should things get dicey and we break below both of these levels then it’s likely a full retest of the ‘flash crash’ low will be order, or worse.

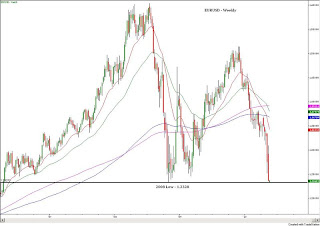

The catalyst for this worst case scenario would in all probability stem from a panic move in the Euro. So far, it is very clear that the announcement of the EU bailout plan is having zero impact to quell concerns over the currencies long term prospects. It is becoming a foregone conclusion in many investor’s minds that one day the EU will cease to exist, or at least in its current form.

Late last week, rumors circulated that Germany was going back to the Marc. Then on Friday, according to one source, Sarkozy threatened to pull France out of the EU if there wasn’t full commitment from everyone to support Greece.

If more unsettling headlines come out of Europe in days to follow then its possible that what will unfold is more panic selling and a continued campaign of aggressive shorting in the Euro resulting in the sinking of European equities and other global risk assets. The Euro, as of Friday, closed at 1.2359 – a mere 31 pips from the 2008 low.

Game-plan for this week:

Continue to pay close attention to the Euro and subsequent reactions in Eurozone equity markets while leaning towards a complete fill of last Monday’s gap in the ES at 1107. Should this level fail to hold then the 200 day ema and sma come into play along with the May 6th lows.

At this point, I suspect we will experience a successful retest (no crash-yet) and the noise from Europe will quiet down a bit, at least for now, as key EU players come to terms in an attempt to ease investor angst and restore some resemblance of order.

Due to a lack of clairvoyance, I will refrain at this time from planning ahead any further until we see how things unfold in the days to follow. However, I do have a big picture scenario I am beginning to piece together for how I perceive events will unfold as we steer towards late summer/early autumn. I will outline my thoughts in detail within the next couple of weeks. Stay tuned………..

.jpg)