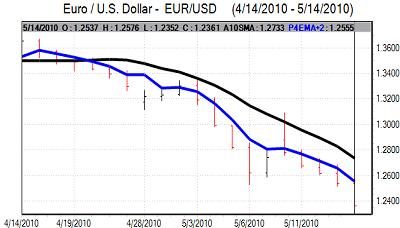

EUR/USD

Support levels held in Asian trading on Friday with the Euro attempting a limited recovery, but it soon ran into fresh selling pressure as underlying confidence remained extremely weak.

There were a fresh round of rumours during the day which continued to undermine the Euro. There were media reports that French President Sarkozy had threatened to pull France out of the Euro if the German government failed to back the Greek support package.

There were also rumours that the French credit rating was about to be downgraded. These reports were denied, but confidence still failed to improve. There were continuing fears over medium-term debt defaults and the risk of very weak growth within the Euro area. There were also fears over an eventual break-up of the Euro area. German Chancellor Merkel stated that success for the support package was not guaranteed.

As far as the US data is concerned, there was a 0.4% increase in headline and underlying retail sales for April and this was the seventh successive monthly increase. There was also a 0.8% increase in industrial production for April while the University of Michigan consumer confidence index also moved higher over the month which will maintain expectations that the US will out-perform the Euro area.

A break of option levels triggered increased selling pressure on the single currency and the Euro retreated to 18-month lows near 1.2350 against the US dollar with the currency also recording the lowest closing level for four years.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan announced that on Friday it will provide a new loan facility and this should help keep interest rates at very low levels, but the market impact was limited as the yen has already been vulnerable on yield considerations.

There was a sharp decline in Japanese equities, but there was little beneficial impact on the yen as it primarily reflected a drop in Sony shares after a disappointing earnings report. Markets are still taking a generally more cautious attitude towards risk which should discourage capital flows out of Japan and provide some yen protection. The dollar weakened to test lows near 92.50 in Asia on Friday.

Risk appetite deteriorated again in US trading as stock price retreated and the US currency dipped to lows near 91.80 before a recovery back to the 92.30 level.

Sterling

The UK currency maintained a weaker tone against major currencies in early Europe on Friday as it tested support levels below 1.46 against the dollar on Friday. Weak sentiment, allied with general selling pressure on European currencies, pushed the UK currency to a low just below the 1.45 level.

Sterling was unsettled by global sovereign debt fears during the day with increasing unease that the UK could get drawn into the European debt crisis and could be subjected to heavy selling pressure on government-debt fears. There was also speculation that the true UK debt position was even worse than recent data has suggested.

Risk appetite was also generally fragile during the day, but Sterling did prove to be more resilient in US trading and held above the 1.45 level against the dollar. In this context, the Euro weakened to lows near 0.8515 against the UK currency.

Swiss franc

The dollar again found support near 1.1150 against the Swiss franc on Friday and strengthened strongly during the day with a peak around 1.1330 in US trading as the dollar continued to gain ground against European currencies as a whole. The Euro was unable to make any progress against the Swiss currency.

With the Euro locked near 1.40, there was speculation that only National Bank intervention was preventing renewed Euro losses.

There was a continuing lack of confidence in the Euro-zone economy which maintained some defensive buying support for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

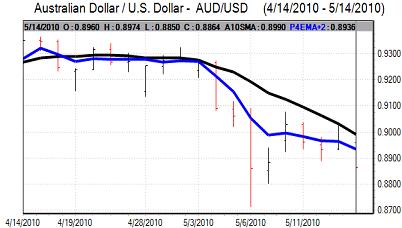

Australian dollar

Overall risk appetite is liable to be generally weaker in the short term and this will tend to limit Australian dollar support, especially if there are a sustained decline in commodity prices.

Risk appetite faded substantially during the day, especially when Wall Street weakened and there was an Australian dollar decline to lows near 0.8850 in New York as commodity prices also came under pressure.