Tuesday closed the day with the Nasdaq Composite modestly green and the Nas 100, S&P 500 and Dow slightly red. The volume came in significantly lighter than Monday’s. The market started weak and moved through yesterday’s highs and at 1:30 started to pull off the highs and actually picked up steam on the drop to close red. The TRIN closed at 1.76 and the VIX at 28.32 on the day. Gold rallied to $1218 +17.20 an ounce and oil fell 43 cents to close at $76.37 a barrel.

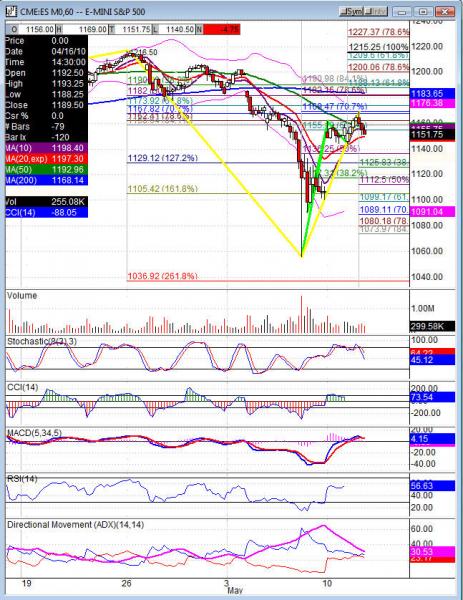

The broader markets rejected 61.8% rejection and the 50dma on the lift. That will be key resistance overhead. The days lackluster lift that quickly gave up ground was not real impressive. The decreasing volume since Thursday is finally flattening off. Futures have not given the weekly pivots a test yet. The past four weeks did test the weekly pivot on a Monday or Tuesday. We do see a week skipped about every 4-5 weeks so not testing this week would not be a big problem. They are generally a nice magnet but with last weeks huge range, it would not surprise me to not test this week. The ES is at 1121.75, NQ 1872.50 and TF 670.90.

Early data into Wednesday and we will also have a watch on today’s lows. That is our key support and we break there a move into the gap still open below us is likely. Unless the bulls can find the momentum to get through the 50dma, we maybe digesting in this area for awhile. That gives the market the time to digest last weeks move and hold our ground in this area.

Economic data for the week (underlined means more likely to be a mkt mover) Wednesday 8:30 Trade Balance, 10:15 FOMC Member Rosengren Speaks, 10:30 Crude Oil Inventories, 1:15 FOMC Member Bullard Speaks, 2:00 Federal Budget Balance. Thursday 8:30 Unemployment Claims, 8:30 Import Prices, 9:00 FOMC Member Kohn Speaks, 10:30 Natural Gas Storage, 12:30 Fed Chairman Bernanke Speaks. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 9:15 Capacity Utilization Rate, 9:15 Industrial Production, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Wednesday pre market M, XIDE, and after the bell CSCO, DRYS, WFMI. Thursday pre market CAE, KSS, SNE, URBN, WEN and after the bell ADPT, BBOX, CA, DDS, JWN, NVDA,VSAT. Friday pre market JCP and nothing

ES (S&P 500 e-mini) Wednesday’s pivot 1155, weekly pivot 1121.75. Intraday support: 1149.50, 1143, 1134.75, 1125.75, 1112.50. Resistance: 1158.25, 1165.25-1166.50, 1169.50, 1172.50-1173, 1182-1183.25-1185.50