Monday brought a nice green day across the broader markets on lighter volume. Thursday and Friday’s volume were very heavy it will be difficult to outperform those days, so I am not surprised by today’s drop. The VIX closed at 28.84 off 29.57% on the day and the TRIN closed at .57. The TRIN spent most the day neutral and fell into the bulls camp with the lift in the last half hour. Gold fell $9.60 to $1200.80 a barrel and oil up $1.69 to $76.80 a barrel.

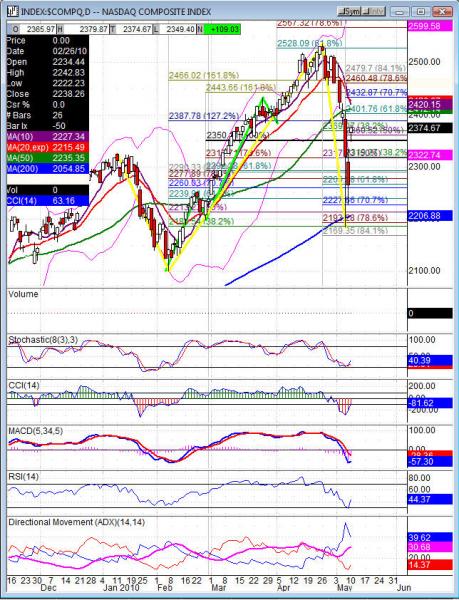

The Nas Composite has erased half of the losses since the April 26th highs. The Nas 100, S&P 500 and the Dow have recovered 61.8% of the losses off the April 26th highs. The indexes sit just under Thursday’s highs getting the market within striking distance of the 50dma’s. The move was fueled in the overnight session with the news of the $1 trillion dollar aid package to the EU bailout. The markets took the sentiment as a quick strike to head off disaster and prevent it from seeping over into other countries/markets.

Other news after the bell is the “one size fits all” push for all the exchanges on a circuit breaker. To help in situations like the market saw on Thursday, I don’t know when something will be put in place or what time line the exchanges would have to implement such policies IF this passes and becomes a new regulation. There are pro’s and con’s to doing this so it won’t be an easy battle to get that consistency in the markets. However, I don’t think as a retail trader this matters to us in a big way, it would probably help slow those fast markets and the protects us.

Into Tuesday I would expect to see some pullback off the closing highs. The indicators all turned up with this move, although the volume was not outpacing the volume we fell on. But as I said given the prior two days volume I can’t put as much weight on volume. A look into the 50dma’s as a key level of resistance will be very rotational for this market. As long as the ES sits over 1155 I will look for 1169.5. A drop of Mondays 1144.25 low lets us look for 1121.25 retracement. The NQ holds over 1932.25 we can look for 1961.50. Break of Mondays 1920.75 low we will look for 1861 support. The TF holding 684.40 we can look for 695.20 and onto 700.60. If the TF drops 684.40 a move into 674.30 and onto 666.50.

Economic data for the week (underlined means more likely to be a mkt mover) Tuesday 10:00 IBD/TIPP Economic Optimism, 10:00 Wholesale Inventories. Wednesday 8:30 Trade Balance, 10:15 FOMC Member Rosengren Speaks, 10:30 Crude Oil Inventories, 1:15 FOMC Member Bullard Speaks, 2:00 Federal Budget Balance. Thursday 8:30 Unemployment Claims, 8:30 Import Prices, 9:00 FOMC Member Kohn Speaks, 10:30 Natural Gas Storage, 12:30 Fed Chairman Bernanke Speaks. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 9:15 Capacity Utilization Rate, 9:15 Industrial Production, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Tuesday pre market ABK, BPZ, NICE, and after the bell ERTS, SPWRA, TIE, DIS. Wednesday pre market M, XIDE, and after the bell CSCO, DRYS, WFMI. Thursday pre market CAE, KSS, SNE, URBN, WEN and after the bell ADPT, BBOX, CA, DDS, JWN, NVDA,VSAT. Friday pre market JCP and nothing

COMPX (Nasdaq Composite) closed +109.03 at 2374.67. Support: 2302.50, 2257.92, 2226.18. Resistance: 2401.64-2412.14 50dma, 2460.48, 2535.28