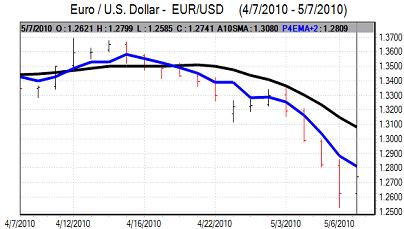

EUR/USD

The Euro found support below 1.26 against the dollar in early Europe on Friday and managed to maintain a firmer tone during the day, although there were still substantial losses for the week as a whole.

G7 members announced that they would hold talks during the day to discuss the situation within Europe and increased stresses within the financial markets. There was speculation that there would be measures to stabilise markets including the possibility of currency intervention, although these elements were denied by sources.

The headline US payroll report was stronger than expected with an increase of 290,000 for April following a revised 230,000 gain the previous month while February was also revised to register a monthly increase. There were firm readings across most sectors even though the numbers were pushed up by the hiring of temporary workers ahead of the census.

The unemployment rate rose to 9.9% from 9.7% as there was a large increase in the workforce which suggests that workers were more optimistic over finding work. The US currency managed to secure increased support on growth grounds following the data, although the influences were mixed as the data also had some impact in calming market nerves which curbed defensive demand for the US currency.

There was a renewed spike in risk aversion during US trading which pushed the Euro down to below 1.2650 before a recovery to above 1.27 on rumours that the ECB would announce a huge liquidity support operation for the banks. Underlying stresses were also illustrated by a further increase in Libor rates.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During the Asian session on Friday, the Bank of Japan intervened to add JPY2trn into the money markets in order to stabilise conditions. Allied with speculation of G7 action, the dollar recovered further to the 92 area against the yen as volatility remained very high. Confidence remained fragile, especially with risk appetite still very fragile.

The dollar gained ground following the US employment data with an advance to just above 93. The yen gained some renewed support later in the US session on reports that some trading in Italian bond futures contracts had been suspended.

There was a fresh change of direction later in New York as there were some rumours of a fresh EMU support package over the weekend and the dollar regained the 91 level, although there were still sharp yen gains for the week.

Sterling

In the General Election, the opposition Conservative party will be the largest party in the parliament, but it will not be able to command a majority. From highs above 1.49 against the dollar, Sterling weakened towards 1.45 in early Europe on Friday on fears over political inaction.

There will be talks over the weekend and any announcement of a deal would tend to boost Sterling in early trading on Monday. In contrast, the currency is likely to be exposed to substantial selling pressure if the stalemate extends into next week.

Underlying confidence in the economy is also likely to remain very fragile, especially with the fact that international sovereign debt fears have increased over the past few weeks. Political and economic factors will, therefore, be closely entwined in the near term.

In this environment, there will be the threat of a sharp deterioration in Sterling sentiment on fears that the budget deficit will not be addressed.

Sterling was able to regain ground later in the US session with an advance back above the 1.47 level following heavy losses over the past 36 hours. From a peak near 0.88, the Euro consolidated near 0.86.

Swiss franc

Volatility remained higher on Friday, although ranges were slightly narrower. The dollar was unable to push above the 1.1180 level against the franc and tested levels below 1.1050 before consolidating slightly higher.

There was no evidence of National Bank intervention during the day and the Euro tested support near 1.4050 against the Swiss currency before finding some relief.

Risk trends will remain important and an underlying lack of confidence in the Euro-zone recovery will continue to underpin the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

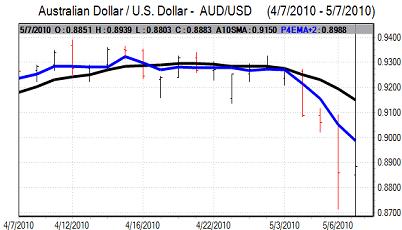

Australian dollar

The Australian dollar found support close to 0.88 against the dollar on Friday, but there was selling pressure above 0.8920 and the currency drifted weaker during US trading.

Risk appetite is likely to remain more fragile in the short term and this will also tend to curb Australian currency support, especially if equity prices are subjected to renewed selling pressure. A firm tone for gold prices should provide some degree of support for the Australian currency.