Friday finished the day with an inside down day helping to digest Thursday’s drop. The Nas Composite, Nas 100, S&P 500 and Dow held just over the 200dma after piercing that support on Thursday. Volume was lighter than Thursday’s but still enough to see participation in the market and more than we had in the first half of the week. The TRIN closed at 2.37 bearish and the VIX 40.95, which was not an inside day. Gold closed up $15.70 to $1213 and oil down $2.00 to $75.11 a barrel.

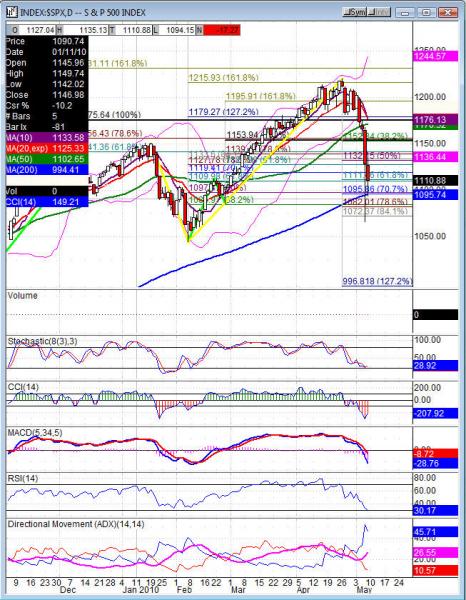

Daily charts on the broader markets have the RSI at 28-29, stochastics turning up and the CCI coming off -200+. With Friday closing lower that leaves stochastics and the CCI with divergence and the RSI oversold. On the weekly charts this drop confirmed the prior weeks bearish engulfing candle. The drop also left the market back to the February 28th range. The slow crawl higher was erased in a few trading sessions. On the weekly charts the CCI is crossing the 0 line into negative territory for the first time since the first week of February. The RSI has fallen off the 76 level two weeks ago to 48. Stochastics came off the overbought conditions and crossed down along with the other indicators after the last two weeks of selling.

Now we know where we sit and can look forward to next week. Economic data is lighter this week and we are seeing more second tier stocks report earnings throughout the week. Friday’s range although an inside bar was still very wide. That makes bracketing the inside bar difficult because we are well beyond our average daily range with the move on Thursday and Friday. Volume was also skewed with this big moves, which makes Monday harder to read. Greece is still hanging out there too and will keep us a little wary until there is some resolution with their debt. Outside of any big news event I expect to see upside retracement on Monday.

Economic data for the week (underlined means more likely to be a mkt mover) Monday nothing due out. Tuesday 10:00 IBD/TIPP Economic Optimism, 10:00 Wholesale Inventories. Wednesday 8:30 Trade Balance, 10:15 FOMC Member Rosengren Speaks, 10:30 Crude Oil Inventories, 1:15 FOMC Member Bullard Speaks, 2:00 Federal Budget Balance. Thursday 8:30 Unemployment Claims, 8:30 Import Prices, 9:00 FOMC Member Kohn Speaks, 10:30 Natural Gas Storage, 12:30 Fed Chairman Bernanke Speaks. Friday 8:30 Core Retail Sales, 8:30 Retail Sales, 9:15 Capacity Utilization Rate, 9:15 Industrial Production, 9:55 Prelim UoM Consumer Sentiment, 9:55 Prelim UoM Inflation Expectations, 10:00 Business Inventories.

Some earnings for the week (keep in mind companies can change last minute: Monday pre market BRK.B, DF, NGS, PETS, TSN, TSN, USM and after the bell DENN, DOLE, IPAR, LM, PAAS, PCLN, TWTC, WINN. Tuesday pre market ABK, BPZ, NICE, and after the bell ERTS, SPWRA, TIE, DIS. Wednesday pre market M, XIDE, and after the bell CSCO, DRYS, WFMI. Thursday pre market CAE, KSS, SNE, URBN, WEN and after the bell ADPT, BBOX, CA, DDS, JWN, NVDA,VSAT. Friday pre market JCP and nothing

SPX (S&P 500) closed -17.27 at 1110.88. Support: 1095.74 200dma, 1082.01-1081.65, 1065.79. Resistance: 1142.80, 1160.97-1170.36, 1186.84