DXJ (WisdomTree Japan Hedged Equity Fund)

Last week I profiled the EFA chart and EFA call option activity. Note the composition of EFA is mostly Japan and European equities. Last week, International Developed Market ETFs added +$1.5B in assets and Japan added $192M in assets. So, it makes sense to look at DXJ – Japan equities without exposure to the yen. In the chart below, the price action is now above the 50d, 100d, and 200d MA. The 50d MA also recent crossed above the 200d MA (Golden Cross) and the 100d MA – these are bullish signs. Note I remain long the DXJ Jan 46 calls at a purchase price of $0.87 (trade date 10/10) to capitalize on further strength in Japan equities.

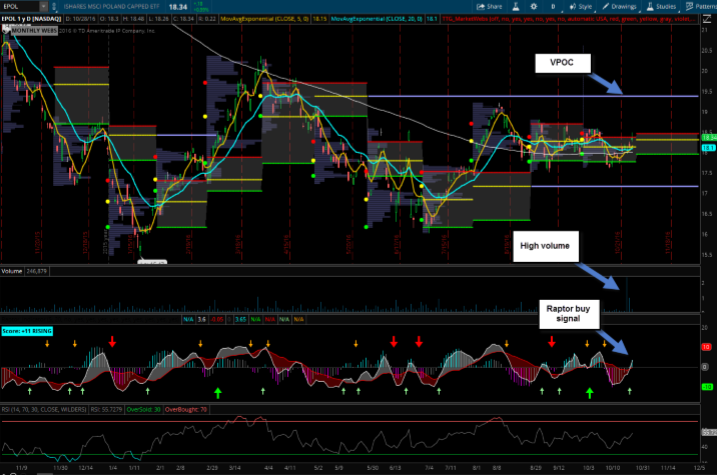

EPOL (iShares MSCI Poland Capped Investable Market Index Fund)

Last Wednesday and Thursday there were block trades of 1mm and 650k shares in the EPOL ETF which is unusual (see chart below). The ETF gained $26M in assets last week proving that these block trades were purchases. From a technical perspective the EPOL is above the 50d, 100d, and 200d MA is showing a recent buy signal on the Raptor Indicator. Note there are no options on the EPOL or PLND ETFs, so this is more of a bullish cash trade that I am looking at. Note the VPOC (Virgin Point of Control) at $19.38, which represents a ~6% move and a good place to take possible profits.

XLF (Financial Select Sector SPDR Fund)

As mentioned above, Financials are one of the few GICS sectors that are above the 50d MA. I believe we are seeing a rotation into Financials and Banks, this is evidenced by ETF fund flows – over the past month Financial ETFs posted +$936M inflows. Note XLF is now a much different ETF that it used to be due to the rebalance that took place last month which stripped out REITs from the XLF ETF – so, Banks and Insurance companies have a much higher weighting than they used to in the XLF ETF, and they both positively correlated to rates rising – (see 2nd chart). Note the US 10yr rate has climbed to 1.85% from 1.55% in just one month. This is bullish for Financials.

LEARN MORE ABOUT CHRISTIAN’S NEWSLETTERS, TRADING ROOM AND WEBINARS AT TRIBECA TRADE GROUP