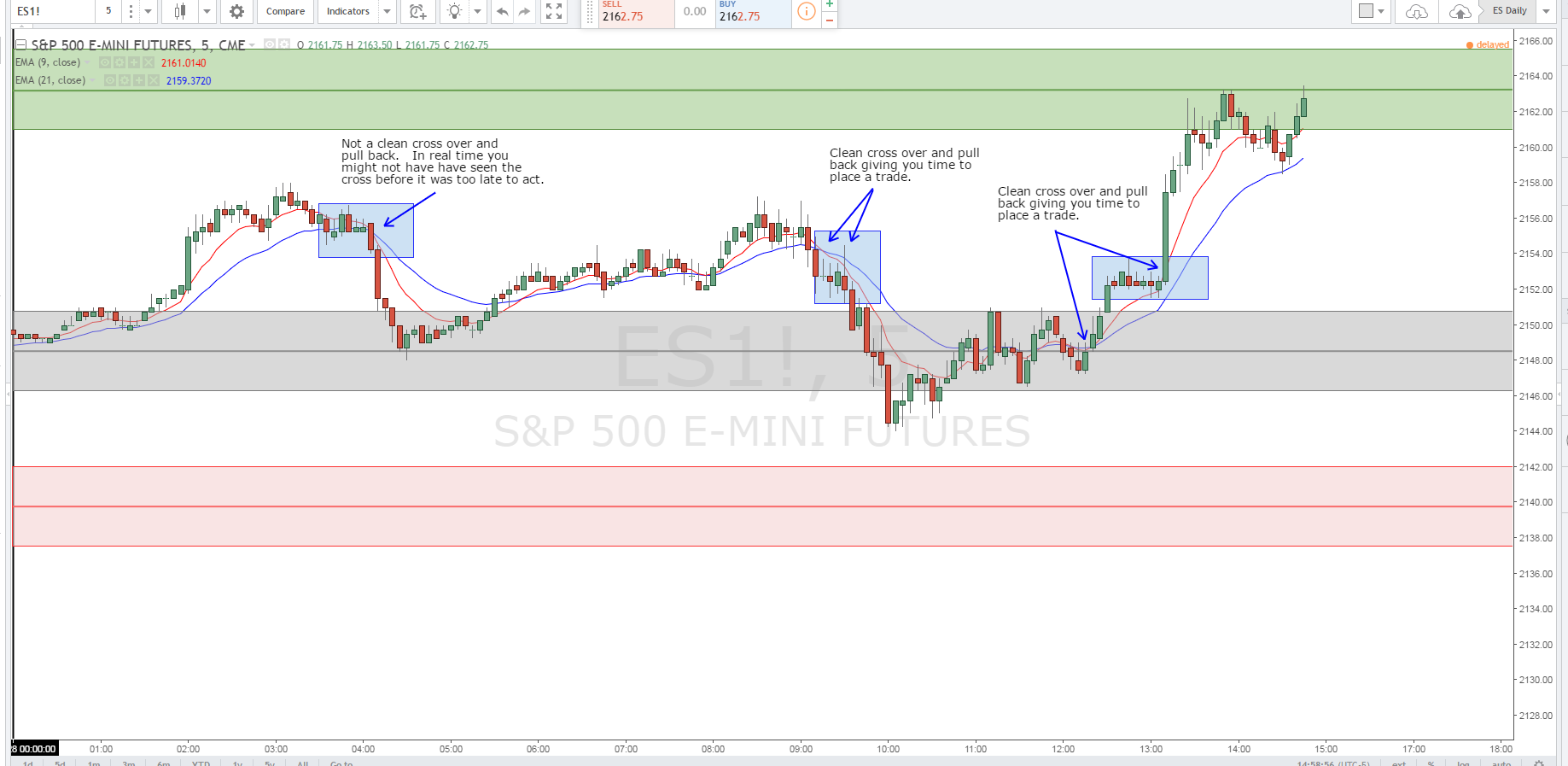

Moving average cross over systems are very simple and very powerful. When combined with your MTB Pro Decision Points, they become a very effective trading system. In the following example you can see how these can be used to keep you on the right side of the market as well as providing you with a few nice trading opportunities.

You will need 2 Exponential Moving Averages. The settings are 9 Period (Fast EMA) and 21 Period (Slow EMA). These EMA’s will work on any time frame but in the examples listed below, we will be looking at them on a 5-minute chart.

Chart 1: Basic 5-Minute chart with decision points and EMA’s drawn. Chart is drawn using the TradingView.com free charting software.

Chart 2: Three examples of EMA crosses with two of the three providing valid setups.

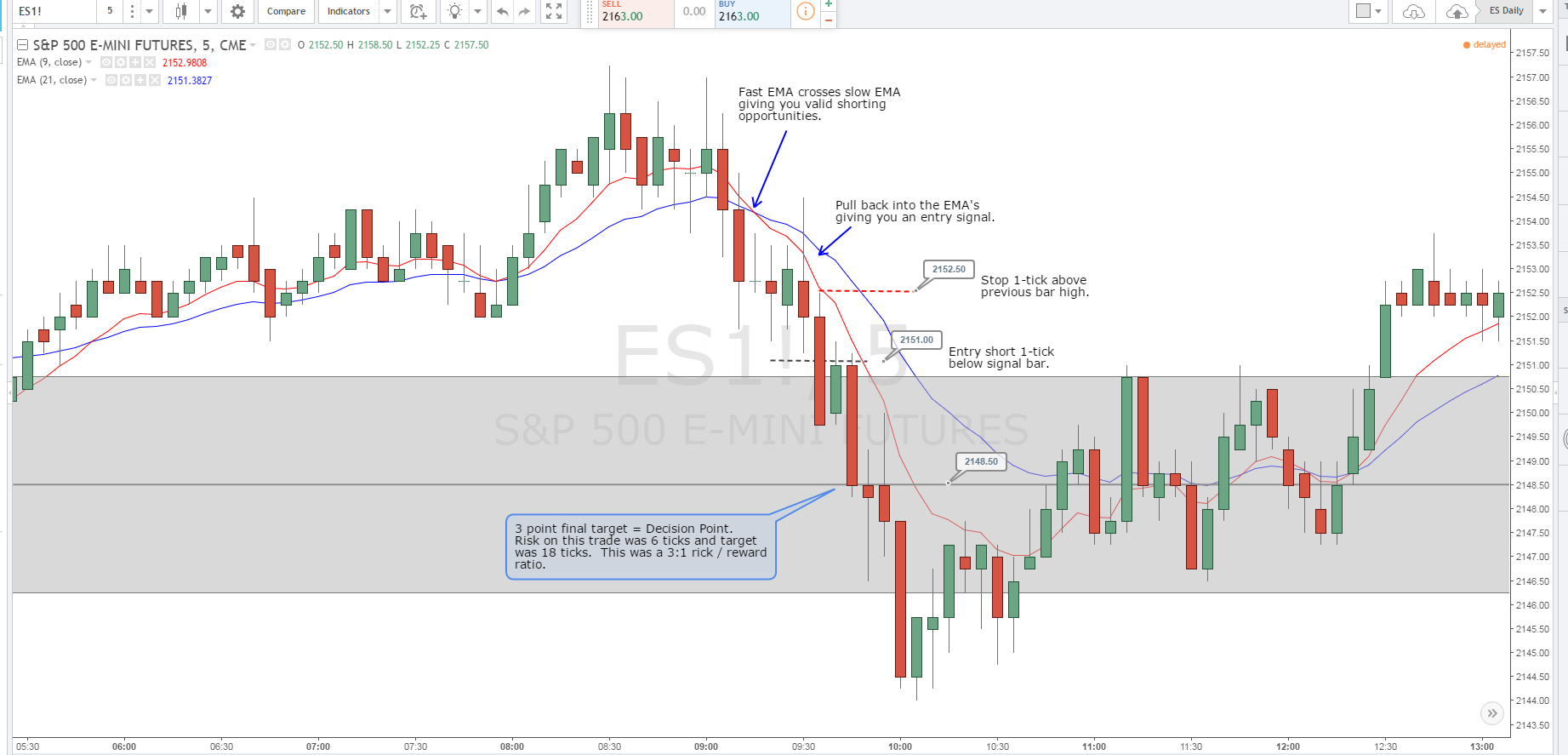

Chart 3: First “clean” EMA cross over detailed. In this trade setup we give you a cross over trade that provides you with a 3:1 risk reward ratio and uses your decision point as a target.

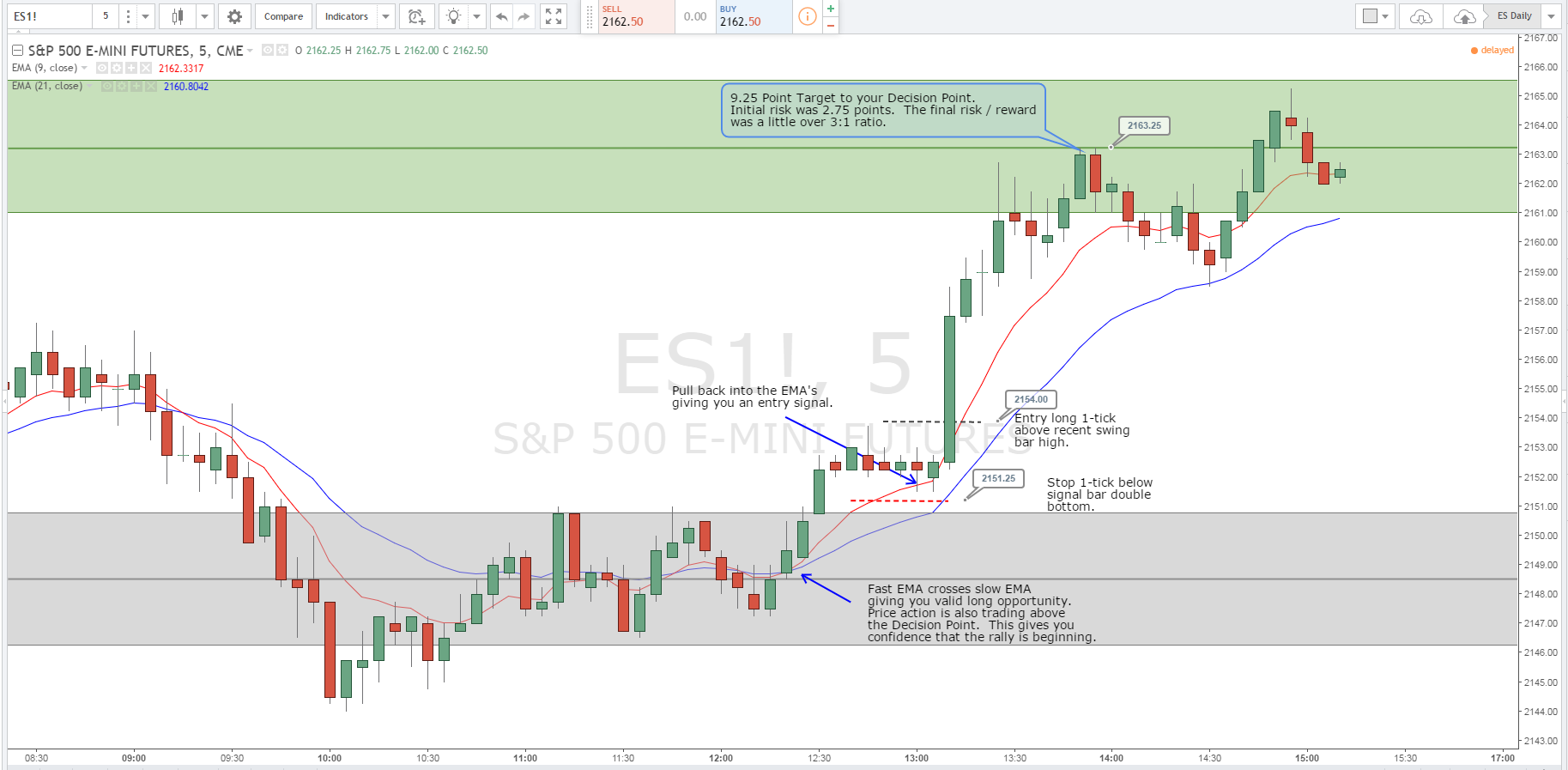

Chart 4: Second “clean” EMA cross over detailed.

Rules of the EMA Cross Over Setup

1.) Use a 9 Period (slow) and a 21 Period (fast) Exponential Moving Average

2.) When the 9 EMA crosses under the 21 EMA then look for short trades. When the 9 EMA crosses above the 21 EMA look for long trades.

3.) Wait for a bar to pull back to the EMA’s either the 9 period (aggressive) or the 21 period (conservative) as your signal that a trade is coming.

4.) Entry should be either 1 tick above for (long) or 1 tick below (short) either of the following:

- The swing high or low of the signal bar

- The high or low of the most recent swing bar

6.) Targets should be at least 1:1 risk / reward and is best served using the decision points are your targets.

7.) Avoid trading during periods of consolidation, especially consolidation around your decision points.

FOR A FREE 7 DAY TRIAL OF MY TRADING BUDDY PRO, CLICK HERE