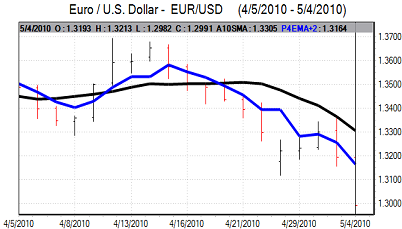

EUR/USD

The Euro was unable to make any headway in early Europe on Tuesday as German retail sales fell sharply which reinforced Euro-zone economic doubts.

Developments surrounding the Greek and Euro-zone debt situations remained very important during the day. Confidence remained very fragile amid fears that the Greek support package would not be effective, especially as it would tend to deepen recession and deflation fears.

There were also a series of market rumors during the day which undermined Euro confidence. There were reports from within Germany that the Greek package would be insufficient over the next three years as a whole. There was also a media report that Spain was seeking a EUR280bn support package to support its own economy. These rumours were denied by Spanish and IMF officials, but overall confidence remained weaker with officials finding it difficult to contain the contagion threat, while there were fears that ECB independence could be compromised in the medium term.

The US economic data was stronger than expected with a 5.3% increase in pending home sales for March while factory orders rose 1.3% for the month. Although of only limited importance directly, the data will reinforce expectations that the US economy will out-perform the Euro area over the next few months. There will also be confidence over a firm Friday payroll report which should underpin the dollar.

Risk appetite dipped sharply in US trading as European debt fears undermined wider confidence and this intensified selling pressure on the Euro with a low below 1.30 during New York trading, the first time this level had been breached since last April.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen remained weaker in Asian trading on Tuesday with a test of important dollar resistance close to 95 as risk appetite was firmer.

Yield factors also remained important with expectations that the trends will continue to move against the yen and trigger further capital outflows into higher yield instruments.

The dollar was unable to capitalise on the gains and dipped back towards 94.30 in US trading. The yen gained significant support as risk appetite deteriorated with falling equity markets curbing capital outflows. The Euro also weakened to a low below 123 against the Japanese currency.

Sterling

The UK currency was still struggling against the dollar on Tuesday with a renewed slide towards the 1.52 level, but held firm against the Euro as European sentiment remained weak.

The PMI index for the services sector was strong at a 15-year high which will reinforce near-term optimism over the industrial sector. In contrast, the consumer and business lending data was much weaker than expected which will maintain unease over medium-term prospects and the risks of a renewed credit crunch, especially with corporate lending falling.

Sterling weakened to a 5-week low against the dollar below 1.51 during the day, but was resilient against the Euro with Sterling strengthening to near 0.8570.

Final opinion polls will be watched closely over the next 24 hours and Sterling could gain some support if there is greater evidence of a decisive outcome. The medium-term government-debt outlook will continue to be an important cause for concern and should limit any scope for Sterling gains.

Swiss franc

The dollar found support below 1.0850 against the Swiss franc on Tuesday and then gained steadily during the day with a high above 1.10 which was a fresh 10-month high for the US currency.

The Euro remained locked close to the 1.4320 level against the Swiss currency as underlying confidence in the currency remained weak.

The sustained lack of confidence in the Euro-zone economy will continue to provide some protection for the Swiss currency. There is likely to be further speculation that the National Bank will decide to abandon efforts to prevent the franc strengthening.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

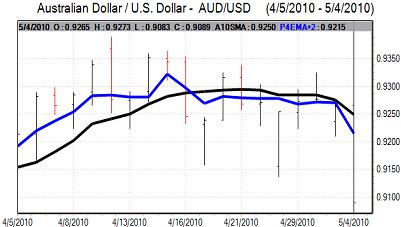

Australian dollar

As expected, the Reserve Bank of Australia increased interest rates by 0.25% to 4.50%. The statement, on balance, was slightly stronger than expected with a warning that inflation will not fall as much as expected, but the Australian dollar was unable to make any significant headway and dipped to lows just below the 0.92 level in local trading.

Risk appetite was generally weaker which stifled currency demand as Chinese equity markets fell again. Fears intensified during the day and the Australian dollar weakened to a low below 0.91 against the US currency as equity markets declined sharply.