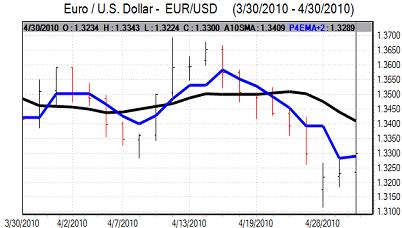

EUR/USD

The Euro was able to resist heavy selling pressure on Friday with a number of mildly supportive factors. There were further intense negotiations surrounding the Greek debt situation. There will be a further meeting of Finance Ministers during the weekend and there will be strong pressure on the governments to secure details of the loan package. Expectations of a deal curbed selling pressure on the Euro and there was some reluctance to hold short positions over the weekend in case there is a gap higher following any weekend deal.

Overall Euro-zone confidence remains weak as structural fears persist. The economic data was uninspiring with the unemployment at 10.0% according to the latest data.

The US GDP data was weaker than expected with an initial estimate of 3.2% expansion for the first quarter compared with expectations of 3.6%. Consumer spending was firm for the period while exports were robust. There will, however, be concerns over a renewed downturn in housing investment for the quarter while there was also a downturn in investment on buildings.

The later economic data was stronger than expected with an increase in the Chicago PMI index to 63.8 for April from 58.8 the previous month while there was also an improvement in the Michigan consumer confidence index which should help underpin yield support.

The Euro pushed to a high near 1.3340 on a covering of short positions before a retreat to just below 1.33 later in the US session as equity markets came under renewed selling pressure. There were also some rumours that international central banks would re-introduce dollar swaps.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese industrial production and unemployment data was slightly weaker than expected which curbed yen sentiment to some extent. There were also hints from Bank of Japan Governor Shirakawa that there could be additional monetary support for the economy over the next few months.

With interest rates held at 0.1%, the yen remained vulnerable to capital outflows on yield grounds and the dollar was able to hold just above the 94 level in early Europe.

The dollar pushed to highs just above 94.50 against the yen early in the US session, but the US currency was unable to sustain the gains and there was a retreat back to the 94 area as risk appetite deteriorated in New York.

Sterling

A reported decline in consumer confidence did not have a significant impact with the UK currency holding above 1.53 against the dollar in early Europe on Friday and there was a subsequent peak close to 1.54 in the European session.

The UK political situation will continue to be watched closely over the weekend and any signs of a decisive election result in opinion polls could be a positive factor for the currency.

Strong buying support looks unlikely, especially as there will be persistent fears surrounding the government-debt situation. Speculation over heavy spending cuts following the election will tend to be a negative factor for Sterling, especially as there would be increased pressure on the Bank of England to keep interest rates at low levels.

The Euro gained some degree of support during the day and this hampered Sterling on the crosses.

Wider currency support also faded during the day and it drifted back to lows below 1.53 later in the US session.

Swiss franc

The dollar hit resistance close to 1.0845 against the franc on Friday and dipped sharply before finding support close to 1.0750. The Euro was unable to make any impression on the Swiss currency and dipped to near 1.4320.

National Bank Governor Hildebrand stated that the bank would continue to act decisively to prevent upward pressure on the franc. He also stated that a rapid solution to the Greek debt situation would be needed to curb upward pressure on the Swiss currency.

The Swiss KOF index strengthened to 1.99 in April from a revised 1.96 the previous month which will reinforce optimism over the economy and should provide some degree of support for the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

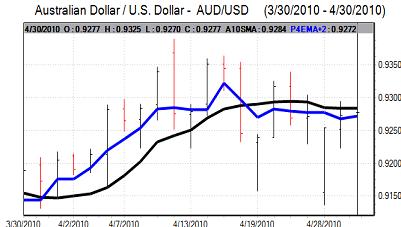

Australian dollar

The Australian dollar pushed to a high near 0.9320 against the US dollar in early Europe on Friday as confidence in the economy remained robust. The currency was unable to extend gains and retreated back towards 0.9250 in New York.

The currency has found persistent difficulties in breaking resistance levels above the 0.93 level over the past few weeks and there was also a deterioration in risk appetite which curbed Australian dollar support.