Now that we are in the last earnings cycle for 2016 it’s time to take a look at CSX.

From Live Vol:

“CSX provides rail-based transportation services, including rail service and the transport of intermodal containers and trailers. CSX serves three lines of business: merchandise business, coal business and intermodal business. CSXs merchandise business consists of shipments in diverse markets, such as agricultural products, phosphates and fertilizers, food and consumer, chemicals, automotive, metals, forest products, minerals, and waste and equipment. CSX’s coal business transports domestic coal, coke and iron ore to electricity-generating power plants, steel manufacturers and industrial plants, as well as exports coal to deep-water port facilities. CSX’s intermodal business combines the rail transportation with the short-haul flexibility of trucks and offers long-haul trucking.”

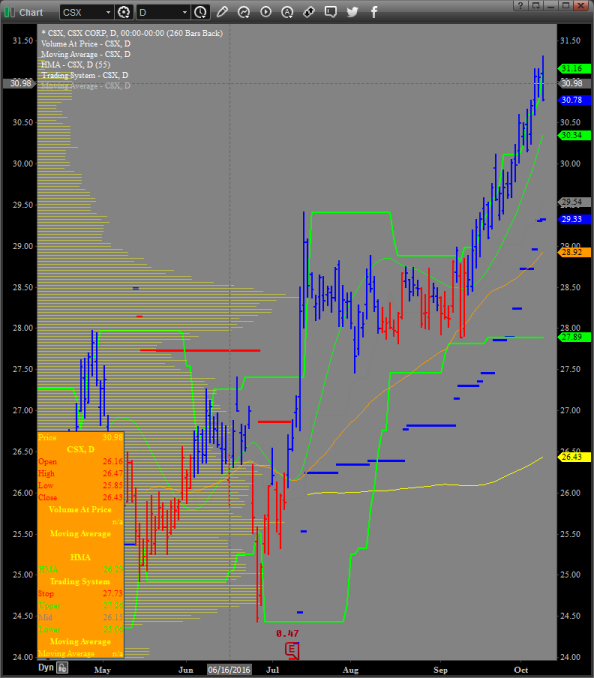

Ok, we get it. It’s a transportation company. Now let’s look at the earnings. The chart is about as firm in a bullish trend that you can get:

Also, CSX has gone up on earnings 5 out of the last 8 times with an average move of 2.3%. The institutional money flow is very bullish, it’s relative strength to the overall market is very bullish and the aggregate fundamentals are neutral at worst, we would like to explore the upside potential. Given the October implied volatility, the market is expecting a move of 3.91% to 5.22%. Targeting a move of 4.5%, we generated the following signal:

Buy (opening) the CSX October 31 C

Sell (opening) the CXS October 32 C

For a maximum debit of $0.30

This provides us with a reward to risk of 2.33:1. This is a bit less r/r than we usually experience for an earnings play, but the summation of the different data provides us with a very compelling case for an upside play and simply these types of companies do not move a ton on earnings so we must adjust our normal risk parameters by just a bit.