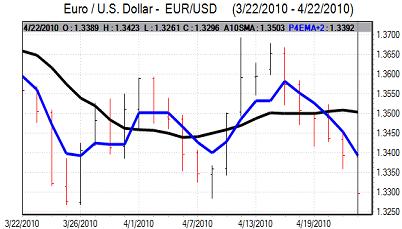

EUR/USD

The Euro remained subdued in early Europe on Thursday with further support below 1.34. As the Euro-zone PMI data remained robust, the Euro was able to resist further selling pressure, but it was unable to make much headway and stalled in the 1.3420 region as underlying sentiment remained fragile.

The situation surrounding Greece and the Euro-zone as a whole remained a very important focus during the day. Ratings agency Moody’s cut the Greek credit rating to A3 from A2 which reinforced the lack of confidence in the debt situation. There was also an upward revision to the Greek 2009 budget deficit to 13.6% of GDP by the European Commission.

Markets will remain on high alert over negotiations with the IMF and there is likely to be further volatility surrounding the debt situation. The lack of confidence was illustrated by a further widening in Greek bond yields over German bunds to a peak above 550 basis points.

The US existing home sales data was stronger than expected with an increase to 5.35mn from a revised 5.01mn the previous month while jobless claims declined to 456,000 from 480,000 the previous week. The data should maintain expectations that the US economy will out-perform the Euro-zone in the short term and this should help underpin the dollar even if further strong and independent buying support will be difficult.

The Euro weakened to lows near 1.3250 following the Greek downgrade which was the lowest level since May 2009 before a correction back to around 1.33.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The March Japanese trade data recorded a 45% increase in exports over the year which helped support confidence in the Japanese economy. There was also speculation that the Bank of Japan would upgrade its economic assessment later this week and this also dampened expectations that the central bank would move to ease policy further.

In this environment, the dollar moved lower to the 92.80 area with the Euro unable to challenge any significant resistance levels.

Ratings agency Fitch stated that there was a risk to Japan’s credit rating and this will tend to reinforce unease over the underlying Japanese fundamentals and this was significant in unsettling the Japanese currency later on Thursday. The US currency was able to find support close to 92.75 against the dollar and it strengthened to the 93.50 area during US trading.

Sterling

The latest UK government borrowing data was slightly better than expected with a monthly borrowing requirement of GBP23.5bn. The annual deficit was also slightly lower than expected at GBP162.5bn, but this was still close to 12% of GDP and will reinforce the lack of confidence in underlying fundamentals

The retail sales figure was slightly weaker than expected with a monthly 0.4% increase following a 2.5% increase the previous month. The overall impact was limited with both sets of data relatively close to market expectations while mortgage approvals also edged higher.

A generally firmer dollar pushed the UK currency to lows around 1.5340 before a small recovery. Sterling was able to strengthen to a 2-month high against the Euro before a slight correction.

Political developments will continue to be watched closely and continuing evidence of an indecisive outcome would tend to curtail Sterling support.

Swiss franc

The dollar found support near 1.0670 against the franc on Thursday and pushed significantly higher in US trading with a peak close to 1.08. There was further Euro support close to 1.4325 against the franc and there was a further strong suspicion of National Bank intervention during the day as the Euro was able to resist losses.

The Swiss currency should be able to find support from the persistent lack of confidence in the Euro-zone economy and Euro.

The Swiss economic data did not have a major impact with a small decline in the ZEW confidence index while there was a solid trade surplus for March.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

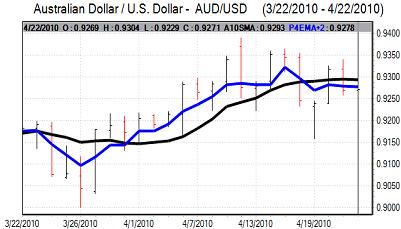

Australian dollar

There was a deterioration in risk appetite during Thursday which curbed demand for the Australian currency, especially with downward pressure on equity prices and the Australian dollar declined to a low near 0.9225 against the US dollar.

There will still be expectations of higher domestic interest rates which should stem selling pressure on the Australian dollar and it rebounded to the 0.9280 area against the US currency as buying support emerged at lower levels.