Today’s Golden Sunrise

Thursday, April 15, 2010

Hours of research consolidated for you

BIG Round Numbers

Tax day…if you paid some, you have an income..if you paid a lot, you have a big income…could be worse.

As I begin this, the ECB has flashed a notice warning of global imbalances…now 7:13am EST…we’ll see what that does, if anything to the relentless rise of markets..world-wide..all of which are now positive with the laggards DAX and CAC now positive..Asia up, except for Shanghai…DAX is -1.72, CAC, FTSE, US Futures positive.

Good to get back to normal…computer issues have been driving me crazy and while not solved have developed safe work-arounds. Might be a video driver of some kind…sorry, for the interruption.

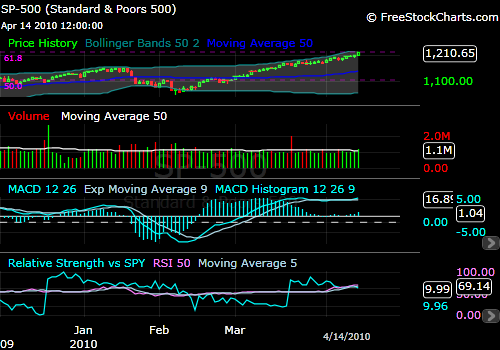

April 13th was a monster up day…much bigger volume as well…day gapped up and just went up and the increase in volume over prior day expanded throughout the session…everything is extended, overbought all that stuff but Mr. Market does what he does and the direction has been higher and appears to have no intention of changing course.

Alcoa reported 1st as it always does…too insignificant to matter..est .09, reported .10 ex-items which when factored in showed a loss of $200million

INTC just blew the doors off the numbers, as did JPM, UPS, CSX and the market has responded by bidding up everything (except fertilizers yesterday where apparently their original product hit the fan).

Check out these numbers:

- The Dow has exploded over 11,000

- The Russell 2000 has vaulted over 700

- The S&P has jumped the creek at 1200 and landed at 1206

- The ASX in Australia rose to 5001.

- The DAX in the last couple of week is over 6000

- The CAC is just over 4000

- The COMP has hopped over 2500

- The Topix in Japan is at 998 as the Nikkei225 climbed over 11,000..Taiwan crossed 8000 on April 1..Singapore went over 3000 last night

- Brazil bumped over 70,000

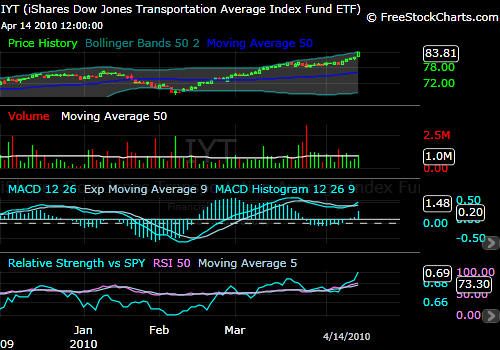

- The Transports..were up over 100 points yesterday!

- Gold, silver, copper, crude all rising

- Happening when the dollar has been in an uptrend

- And interest rates are going up…

Big round numbers catch the eye and draw attention…they tend to be numbers that draw indexes close to them, then provide resistance and a retreat to build momentum to “jump the creek”-a market analysis concept from pioneer Richard Wyckoff in the early 30s. These markets pretty much just leapt over them in one big bound.

Once over the creek, the boundary now crossed generally provides support. We’ll see what happens from here.

The are a million charts, from all over the world, that all look the same these days. This is a daily S&P.

The transports don’t get featured much: last week up on rising volume and positive momentum.

Given that so few of the Dow “industrials” are industrial, I’m not too sure that the transports confirm anything but the fact that UPS, FDX, the big rails, are doing well and that is a fundamental strength without or without the DJIA.

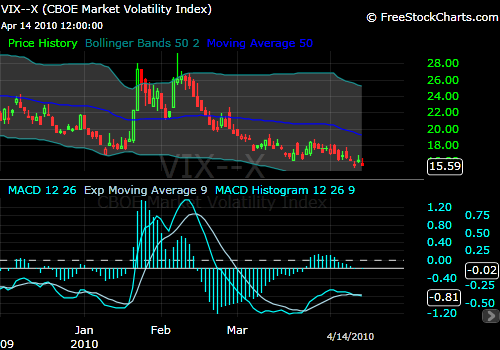

The VIX shows traders expect little volatility in the trends for the next 30 days..which will play out q1 earnings for the most part?

Volumes have been better the last couple of days but have only returned to about average levels of the not-that-distant past.

Forecasts for the 2H are improving..now seeing estimated earnings of $100 for the S&P and at 15x, projections of 1500 for that bellwether indicator.

It seems as if we are in a don’t chase but don’t short phase.

JohnR

Goldensurveyor.com