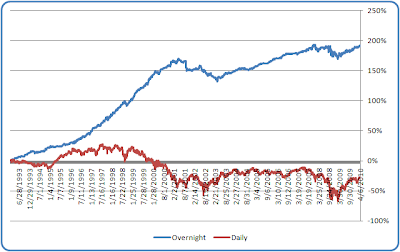

It has been a while since I have looked at this — here is an updated chart of the cumulative performance for the SPY S&P500 proxy ETF for its Daily versus Overnight Sessions since inception:

As shown, it comes as no surprise that they have been more aligned to the upside than not since March of 2009. However, throughout the history of the security, the overnight session has far outperformed in terms of both absolute, and especially, risk adjusted returns. While I’ll grant that the opening price data is likely more suspect than the close due to opening cross procedures, the “tale of two markets” is told nevertheless.