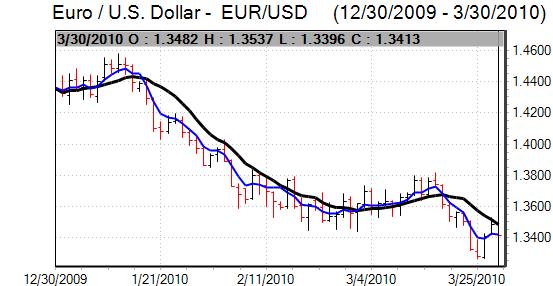

EUR/USD

The Euro pushed to highs above 1.3520 against the dollar in Asian trading on Tuesday, but was unable to sustain the gains during the day.

The latest house-price data recorded a small seasonally-adjusted increase for January with the lowest annual decline for three years. The US consumer confidence data was slightly stronger than expected with an increase to 52.5 for March from a revised 46.4 the previous month. There was an improvement in optimism surrounding the labour market which will help maintain some degree of optimism over the economy. There will also be expectations of a robust reading for the March employment report due for release on Friday which should support confidence.

Before then, the important ISM manufacturing report will be released on Thursday and a strong reading would help underpin dollar confidence. The US currency should also tend to gain support on yield considerations as Treasury interest rates continue to rise. There will be a mixed impact as there will also be fears that rising yields are a signal of weaker international demand for bonds.

There were still hopes for calmer conditions and improved sentiment surrounding the Euro-zone economy and Euro. Confidence was still fragile and a renewed widening of yield spreads between Greek and German bonds undermined the Euro later in the European session, especially after rumours that French credit ratings could be downgraded.

The Euro was unable to hold above 1.35 and dipped to lows just below the 1.34 level later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The domestic economic data was slightly weaker than expected with a 0.9% decline in industrial production for February, which was the first decline for 12 months, although this was in line with market expectations. There was also an unexpected annual decline in household spending which will maintain pressure for an expansionary Bank of Japan monetary policy to help support the economy. Risk appetite was still broadly firm which will curb defensive yen demand.

There was evidence of exporter selling on dollar rallies which helped limit any selling pressure on the Japanese currency as ranges remained narrow. The dollar again hit selling pressure above 92.50, although downside pressures were limited.

The dollar gained renewed support from higher yields in US trading and there was a renewed test of resistance in the 93 area during US trading.

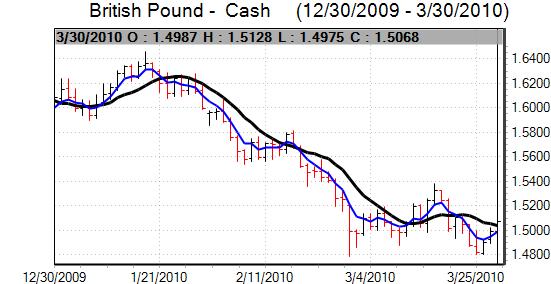

Sterling

Speculative short Sterling positions remain near record levels and this will maintain the possibility of a UK currency rally on position adjustment, especially if global risk appetite remains strong.

Sterling pushed above 1.50 on Tuesday as the dollar maintained a slightly weaker tone. GDP growth for the fourth quarter was revised up to 0.4% from 0.3% previously which provided some degree of Sterling support and the quarterly current account deficit was also sharply lower than expected which should help ease financing fears.

In addition, the Nationwide reported an increase in house prices for March, reversing February’s decline, which helped ease immediate fears over the economy.

There will still be important fears over the UK debt levels and the proximity of a general election is likely to ensure that confidence remains fragile as medium-term fears over a credit-rating downgrade continue. Euro vulnerability was still an important feature and Sterling strengthened to a 1-month high near 0.8880.

Swiss franc

The dollar found support below 1.06 against the franc on Tuesday and strengthened to a high around 1.0680 in US trading. The Euro was unable to make any further headway against the Swiss currency and edged back towards the 1.43 level during US trading.

Underlying confidence surrounding the Euro-zone remained fragile and this will tend to limit the scope for Euro gains.

The UBS consumption index dipped lower for March which may raise some doubts over the strength of consumer spending, but the economic indicators overall have remained generally robust which will limit the impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar strengthened to highs above the 0.92 level against the US dollar on Tuesday on a combination of robust risk appetite and underlying confidence in the global economy.

The currency was unable to hold above 0.92 and dipped to lows near 0.9150, but the currency was still generally resilient and edged higher again later in New York. Overall confidence should remain broadly firm in the near term which should limit losses.