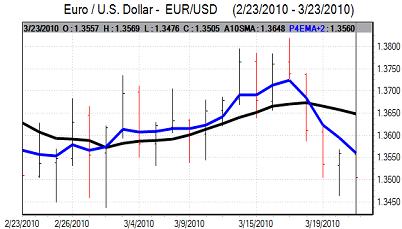

EUR/USD

Market ranges were subdued in early Europe on Tuesday with the Euro holding above the 1.35 level against the dollar, but it retreated quickly from levels around 1.3560 as underlying sentiment was still weak and resistance held.

The Greek budget situation remained an important focus during the day and contributed to further choppy trading for the Euro, although there was no break of significant technical levels.

There were comments from German officials which suggested that the EU members would not be able to secure agreement for a Greek aid package and this would increase the risk that IMF support would be needed. A key feature will be persistent uncertainty which will undermine investor confidence. In this environment, overall confidence in the Euro remained weak and there was further speculation over an underlying medium-term asset allocation switch away from the currency.

The US existing home sales data was close to market expectations with a decline to an annual rate of 5.02mn for February from 5.05mn previously. US house prices were also reported to have fallen in January, but the overall impact was limited with markets still expecting the Federal Reserve to tighten before the ECB.

The Euro was again blocked above 1.3550 against the dollar later in the US session and settled back near 1.35 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite was again generally firm in Asian trading on Tuesday which curbed immediate demand for the Japanese currency with markets looking to take an optimistic target towards the global economy. The dollar was still unable to make much headway and was holding just above the 90 level.

The US currency edged higher towards 90.50 later in the US session as ranges remained narrow with the yen losing some support as Wall Street rallied in late trading. There is still likely to be speculation over increased carry trade activity, especially if the Australian dollar is able to make headway.

Sterling

The headline consumer inflation rate was slightly lower than expected with a decline to 3.0% from 3.5% the previous month. This may tend to undermine Sterling slightly on reduced fears over the near-term inflation outlook and the Bank of England may have greater scope for additional quantitative easing if the economy appears to be deteriorating again.

The latest CBI retail sales survey weakened to a headline 13 from 23 the previous month while the survey was cautiously optimistic over March’s outlook. Sterling tested levels below 1.50 against the dollar before recovering again as bidding interest returned at lower levels.

The government’s fiscal policies will dominate on Wednesday with the budget release due early in the US trading session. There will be expectations that the government will be able to announce slightly lower budget deficit projections for the next two years which could underpin Sterling to some extent.

Markets would prefer more details of a credible medium-term deficit reduction plan and the UK currency is likely to be subjected to heavy selling pressure if there are fresh spending commitments.

Swiss franc

The dollar was unable to break above 1.0650 against the franc on Tuesday and retreated to lows near 1.0570 in US trading. The US currency was again undermined by wider franc strength on the crosses as the Euro was subjected to further sustained selling interest as it tested support below 1.43 with a slide to near 1.4260 during New York trading.

National Bank President Hildebrand again warned against excessive franc appreciation, but the Swiss currency quickly recouped initial losses amid speculation over further medium-term gains for the Swiss currency.

A lack of confidence in the Euro will continue to provide important support for the franc, especially as it is proving highly resistant to losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

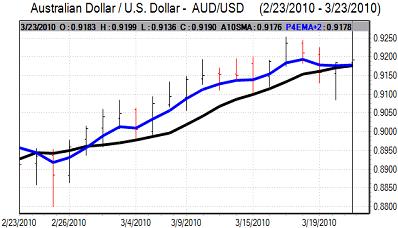

Australian dollar

The Australian dollar found support above 0.9120 against the US dollar on Tuesday and pushed higher during the day, but was unable to break above the 0.92 level.

Risk appetite held generally firm during the day which helped underpin the currency and there will be some further speculation over capital inflows funded through the yen which could provide further near-term support for the Australian dollar. AS equity markets rallied, the currency returned to its best levels.